What is the important signal to the two groups of stock exchanges / growth of automotive and pharmaceutical symbols?

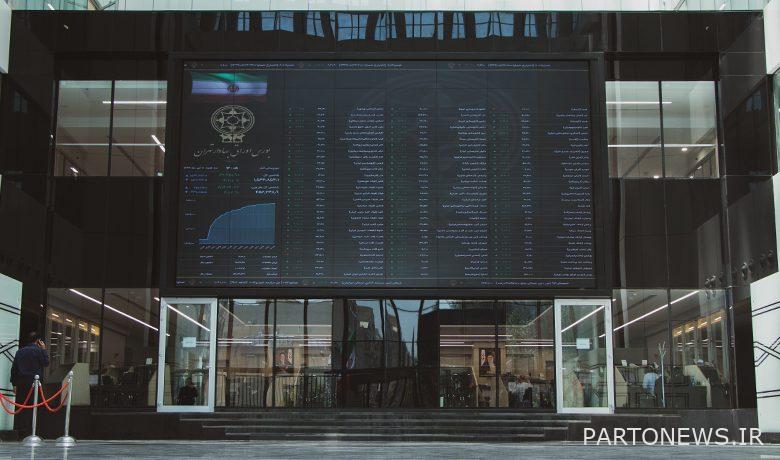

According to Tejarat News, the overall stock market has been negative in the past two weeks. In addition to large market indices and symbols, small market symbols also declined, and now the trend of the capital market in the coming days is unclear due to ambiguities in the overall economic environment and government policies.

The initial public offerings, which entered the capital market consecutively in the past weeks, played an important role in further market decline, and estimates show that about five thousand billion tomans of liquidity has left the market due to the purchase of offers.

Another reason for the decline Stock market According to stock market experts, it is the length of the Borjam negotiations that has a negative impact on the stock market trend, and now various scenarios for the market trend and the stock exchange industry have emerged after the Borjam negotiations. According to Salman Nasirzadeh, a stock market expert, if the Borjam negotiations succeed, it is likely to have structural differences with Borjam in 2015 and will have a temporary effect on the dollar in the short term, so psychologically damaged industries such as automobiles Transfers and banks will be considered by stock market activists in the short term. But what will be the reaction of other groups to the published news?

The reaction of car symbols to the liberalization of car imports

According to many experts, with the liberalization of car imports, the price of cars in the country is moving towards realism, and incidentally, it is not a barrier to the competition of domestic cars. But if this plan is implemented, what effect will it have on car stocks?

Nima Mirzaei, a capital market expert, told Tejaratnews about the impact of the car import liberalization plan on the automobile group: “The automobile import liberalization plan created a wave of positive and negative reactions among economic actors, including the automotive group shareholders.” The plan, which seems to be going through a difficult and tumultuous path until final approval and notification, was eliminated at the very beginning of its trump card, which was the import of a second-hand car! But if passed in the same way, it will have two disproportionate effects on the automotive group and parts manufacturers.

He also added: “The positive effect of this issue is due to the classification that one of the conditions for importing cars is the currency due to the export of cars or parts, and this has created a privilege for domestic companies, which naturally has a significant impact due to the potential attractive profit of imports.” On the financial statements of automakers and their subsidiaries.

The reaction of the pharmaceutical group to the signal of currency removal of 4200 Tomans

Preferential currency (4,200 Tomans), which has been allocated in the general budget of the country since 2009, was supposed to be completely removed from the budget this year, now that three years have passed since this currency was allocated to non-essential goods and corruption in the country’s economy as much as possible. The Minister of Health reports that the currency is corrupt in pharmaceutical products.

Bahram Ainollahi says in this regard: The allocation of preferential currency for medicine is currently continuing until the end of this year, but the plan is to remove the currency of 4200 Tomans for medicine and pay the difference to the insurance companies.

The Minister of Health also says in another part of his interview with Fars: “By removing this currency, the cost of medicine will be paid to the people through insurance.”

Navid Qudussi, expert Stock market Regarding the effect of removing the preferred currency from pharmaceutical items, he told Tejarat News: “By removing the preferred currency, the cost of products of pharmaceutical companies will create a price jump, and as a result, they will have to raise prices to compensate for the rising production rate.” But the question is whether society will accept such a price increase?

Navid Qudussi says in another section: If we look at this issue from another angle, by eliminating the 4,200 Toman currency, companies and groups that produced their raw materials with this currency will benefit, and as a result, the group of pharmaceutical symbols will benefit from this issue. But this profitability is practical if the profit margins of companies do not change.

Explaining this issue, he said: “Drugs are one of the most important livelihood products of the people, which due to the inflationary situation in the country, the increase in prices of pharmaceutical items leads to popular protests, and the government tries to control prices, which reduces profit margins.” Companies and their losses end.

Read the latest stock market forecasts on the Forex Trading Forecast page.