3 reasons for Atrium to fall 25% in the next month

The fundamental, technical, and intra-chain factors associated with atrium are largely indicative of a possible decline in the price of this digital currency in the coming weeks. As can be seen from the graphs, Atrium’s next target could be 25% lower than current levels.

To Report Atrium has lost more than half its dollar value in 2022. The digital currency has also lost value against bitcoin and now remains below the $ 2,000 mark for a variety of reasons.

In addition, available data suggest that the price of Atrium in June may fall further due to other factors, which we will discuss below.

Atrium funds have lost a large part of their capital

CoinShares reports on May 31st show that digital currency market investors withdrew about $ 250 million from Atrium-based mutual funds in 2022.

However, the net inflow and outflow of funds based on digital currencies has not been as high as Atrium. In 2022, for example, investors added about $ 369 million to bitcoin-based mutual funds.

At the same time, Atrium’s first-tier Chinese block of protocols fund, Solana and Cardano, have raised $ 104 million and $ 9 million, respectively.

Capital withdrawals from Atrium-based funds show that Luna and UST (Terra Ecosystem Tokens) have reduced investor interest in Decentralized Finance (DeFi) with their recent collapse.

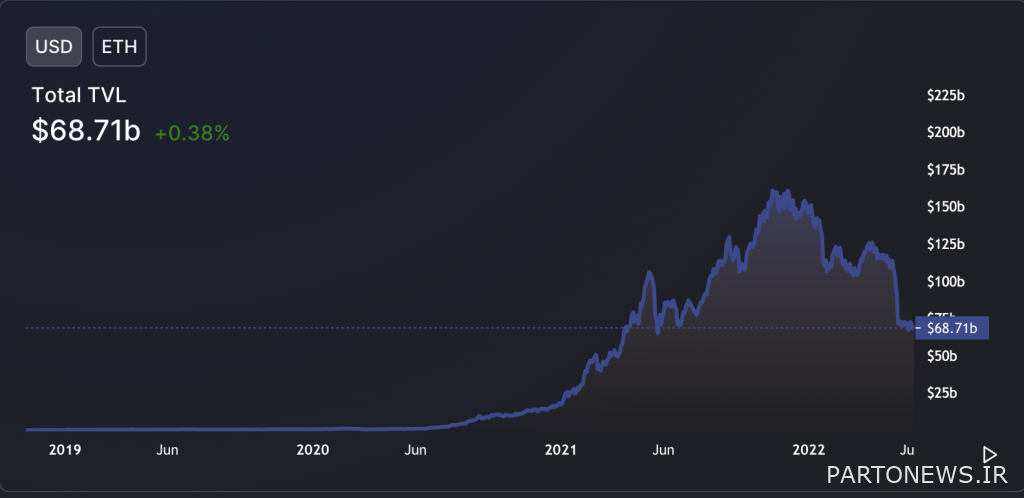

Analysts who have predicted that the Atrium trend will be bullish in the future have mostly made their predictions based on the Defy market boom; Because Atrium Blockchain hosts most of the programs in this section. As of June 5, the total value of locked-in capital of Atrium-based programs was $ 68.71 billion, which is approximately 65% of the total value of locked-in capital in the Defai sector.

However, the total value of Atrium Locked Capital shows that a large proportion of Atrium Def pools have experienced capital outflows. It is worth mentioning that the total value of the locked capital in the mentioned pools on May 9 (June 19) and before the fall of Luna Classic and UST Classic was in the range of 100 billion dollars.

According to Ilan Solot, a shareholder in Tagus Capital, macroeconomic risks stemming from the US Federal Reserve’s contractionary monetary policy, as well as the cautious outlook for the defense sector. Atrium trends in June continue to decline.

“Solot told the Financial Times:

If the Federal Reserve continues its contractionary policies, the world is still in recession, and people are still forced to pay $ 4.5 per gallon of gas, they will have less money to invest in defai or participate in blockchain-based games.

Atrium is not in good technical condition

Atrium trading trend in May indicates that the price of this digital currency is likely to continue to decline in the future.

The atrium is in a fluctuating range with a horizontal support line and a descending resistance line. This pattern is almost similar to the “descending triangle”, which is a kind of continuous descending pattern.

According to the rules of technical analysis, the pattern is formed in such a way that first the price falls completely below the pattern support and then decreases to the maximum height of the triangle; Just like what is shown in the image below.

If Atrium falls below the support line below the downtrend, it may reach $ 1,350 in June. It should be noted that this level is about 25% lower than the current price of Atrium.

Atrium exchanges are on the rise

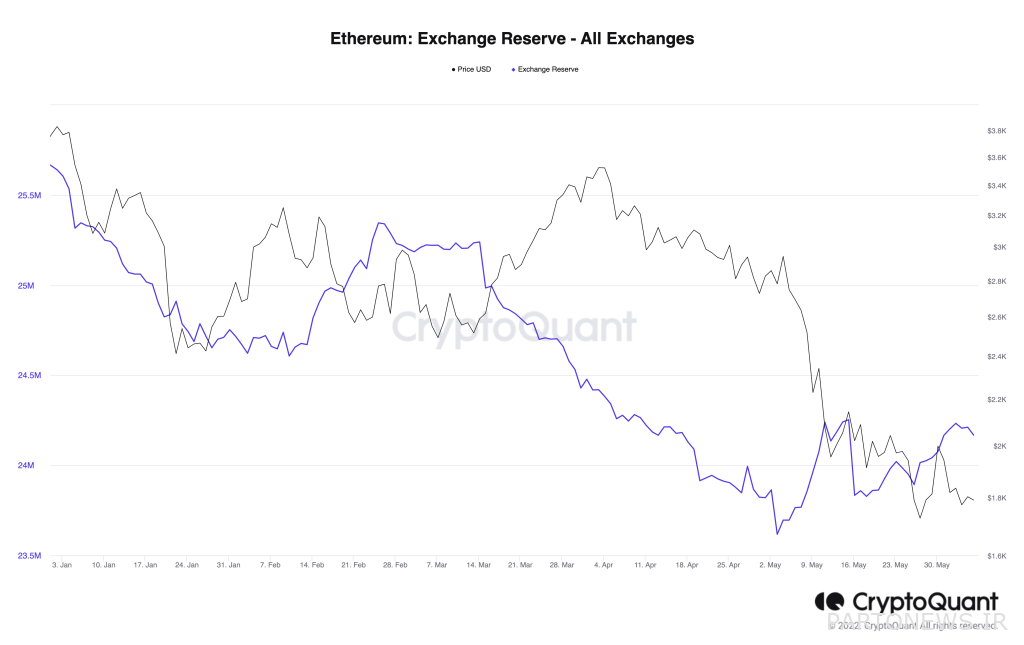

Data from the CryptoQuant website show that the total number of atriums in digital currency exchanges has increased by 550,459 units since the beginning of May.

About $ 950 million of Atrium has been deposited in wallets in digital currency exchanges since the Tera abruptly began, according to the data.

Traders usually bring their tokens into exchanges when they want to trade them with other assets. As a result, if the downward trend of Atrium Exchange’s inventory changes and rises in recent months, its selling pressure is likely to increase.