4 Golden Tips for Managing Home Expenditures / The Difference Between Savings and Investment

Life group: In the custom of a common life, the man is responsible for providing the living expenses. It may be agreed in other families, but even when the man is fully responsible for the house, the woman is still involved in some way in spending and categorizing the expenses of the house. From the shopping list she sends to the man, to the children’s necessities and the expenses of a party or a trip.

Here are four key pointers in moving your family forward. It does not matter which money a man or a woman finances and which one has more control over what they spend. Knowing these points will help to better balance the income and expenses of the family.

Spend money with the program

Planning and having a plan to spend money may be a very repetitive advice. But the fact is that no matter what you write on paper or what you have in mind, without it you are wasting your financial resources and spending more or less what you owe your family.

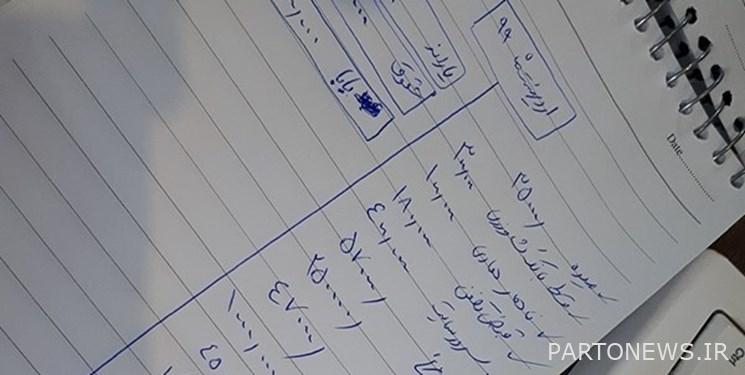

Dividing home expenses into short-term, medium-term and long-term is one of the most successful methods of financial planning. In the meantime, there must be a series of expenses that can be postponed until the coming months without any problems. Necessary and daily expenses are better covered and in the meantime, you will definitely have a more open hand to spend. Because you know very well what you will buy and what you will not buy in this month, the coming months, or any start-ups that you have planned for your expenses.

Budget and agree

Now it’s time to list the demands of family as well as the necessities of life. Some people do not like to write these things on paper and feel that they are being overwhelmed by the mathematical equations of income and expenditure. no problem! But be sure to keep this budget in mind, and if the family of the person you care for has a financial request for you, let them know when you can meet their financial needs according to the family budget.

In the meantime, prioritizing family needs according to budgeting is also important. An important lesson for children can be provided in this budgeting. Suppose your daughter sees a shoe in the market and likes to have it, while her shoes are still usable. On the other hand, the son of the family, who does not have sports clothes, has to buy a pair of sports clothes. The father’s car insurance will expire next month, and the mother will need to see a doctor.

Normally, seeing a doctor and getting treatment is a priority. The need for clothing is another essential expense. The father can set aside some of the car insurance money this month, but the purchase of new shoes for a family member who still has shoes is postponed to the next month or months.

Savings for everyone

Saving means setting aside a portion of your income, whether you are part of a high-income or low-income family. Some people think that if they have a few million extra, they can allocate it to savings, while the range of income, the range of expenses and expenses. So, saving is an art that should come from any amount of income.

Women are often ahead of men in terms of savings. They can sometimes make big savings with small savings on household expenses and children without harming the home and family.

On the other hand, sometimes with a little strict spending and contentment, you can get savings that can be used to respond to one of the big expenses of home or family entertainment such as travel. We must always remember to “gather little by little, and then become the sea.”

Another important point about savings is that you have a schedule to spend it. For example, if you are going to collect a certain amount for a year after three months, do not use it in case of emergency. This will put the savings into a fruitless cycle.

The difference between investing and saving

Saving is an amount left for the day or a special expense. But in investing, you move part of your money with an economic mindset and, of course, share in the profits and losses. That is why investment management is more important and complex than savings management.

There are many ways to invest these days. If you have good savings or money left over, invest in consulting with family heads so that the money can circulate during the recession and you can get a monthly or occasional profit.

End of message /

You can edit this post

Suggest this for the front page

.