Analysts: Bitcoin collapse has not yet reached its peak; Signs of decline in the market

Although retail traders have high hopes of maintaining the $ 20,000 Bitcoin support range, futures trading and options trading options show that these traders as long as the terms of digital currencies and companies in the industry are clear. Otherwise, they do not trust cross-sectional upward movements.

To Report Coin Telegraph There is a big downward trend in the Bitcoin monthly chart. The level below $ 18,000, which was reached at the beginning of this week, was the lowest price that this digital currency has experienced since December 2020. Bitcoin buyers are now hoping that Bitcoin can turn the $ 20,000 range into support. However, the derivatives market indicators are in a completely different context and show that professional traders are still hesitant about the future of the market.

You may recall that the S&P 500 index fell 11 percent in June. Shares of multibillion-dollar companies such as Netflix, PayPal and Caesars Entertainment also fell 71%, 61% and 64%, respectively.

The US Federal Reserve Committee also raised its bank interest rate by 0.75 percentage points on June 15. In addition, Federal Reserve Chairman Jerome Powell said US officials were still working to curb inflation and that interest rates could rise further. However, investors and analysts are concerned that these monetary policies will increase the risk of recession.

The Bank of America said in a note to its customers on June 17:

The thing that scares us the most about the Federal Reserve has now been confirmed. They are behind schedule and have started a dangerous game to make up for this delay.

In addition, according to analysts at JPMorgan Chase, the high share of stable coins in the digital currency market, which reached a new record, indicates that the market has entered a saturation zone and can now grow significantly. . According to these analysts, if the share of stable coins in the total digital currency market decreases, it indicates that the market has limited potential.

Currently, investors in the digital currency market are experiencing different emotions. On the one hand, they are afraid of a recession and on the other hand, they are optimistic about the strengthening of support for $ 20,000 Bitcoin; This is because the capital in stable coins may eventually flow into bitcoins and other digital currencies. Therefore, we need to look at derivatives market data to see if investors are more fearful or optimistic.

Bitcoin futures premium was negative for the first time in a year

Retailers typically avoid quarterly futures contracts because of their price differences with current markets. However, professional traders prefer to use this type of trading to avoid constant fluctuations in the rate of financing.

The term capitalization rate in the futures market refers to the amount of commission that long contract holders (those who believe prices rise) and short contract holders (those who believe prices fall) must pay to keep the market in balance.

These contracts, which have a fixed monthly period, are usually traded at a lower premium than the instant markets, because investors need more money to avoid settling. It should be noted that this situation is not unique to the digital currency market. In general, futures contracts should be traded at a premium of 5 to 12 percent per annum in healthy markets.

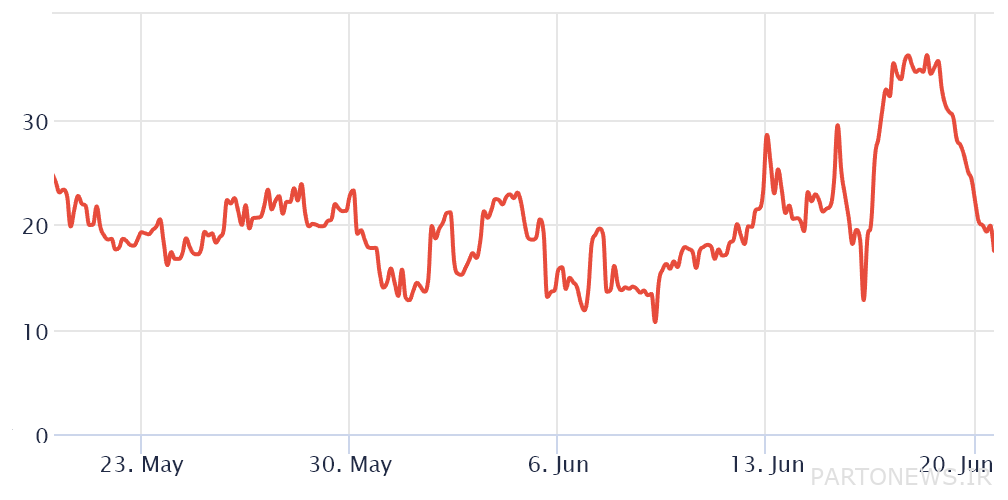

As you can see in the chart above, the Bitcoin futures premium has not been able to cross the 5% neutral threshold. Meanwhile, Bitcoin was able to maintain support of $ 29,000 until June 11 (June 21). Whenever this index decreases or becomes negative, a worrying situation arises and indicates a downtrend and a situation known as backwardation.

To eliminate external factors specific to futures, traders must also analyze the Bitcoin option markets. For example, the Delta Skew Index of 25% indicates that bitcoin market makers and arbitrage trades are willing to spend more to protect themselves against uptrend or downtrend.

In bullish markets, investors are likely to expect the price of their digital currency to rise, resulting in a delta deviation below minus 12 percent. On the other hand, when investors are afraid of falling prices, the delta deviation index reaches a positive 12% or higher.

The 30-day delta deviation of the Bitcoin trading market reached 36% on June 18 (June 28), which is its highest record and indicates a very downward market. Apparently, the 18% increase in the price of Bitcoin from $ 17,580 was not enough and could not regain the trust of traders in the derivatives market. Although the current 25% delta deviation still indicates the risk of falling prices, at least it no longer reflects the intense aversion of traders.

Analysts expect the greatest possible damage

Some indicators indicate that Bitcoin may have reached its price floor on June 18 (June 28). This theory is especially reinforced by the formation of $ 20,000 support.

On the other hand, digital currency market analyst Mike Alfred has explicitly stated:

Bitcoin has not yet liquidated large investors. Prices fall to the point where they do the most damage to investors like Celsius, in whom they have invested too much.

Unless traders are fully aware of the risks posed by the spread of the Tera network crash to other digital currencies, the possible bankruptcy of Celsius, and the liquidity problems of Three Arrows Capital, the price of bitcoin is likely to fall again.