Analysts’ opinion: Bitcoin will pass the FTX crisis

The trading team of Stockmoney Lizards believes that Bitcoin will survive the collapse of the FTX exchange as well as previous market crises. The team says the events we are witnessing now are nothing new for Bitcoin.

To Report Cointelegraph, despite the fall of 25% in the price of Bitcoin in just a few days, it cannot be said that the bankruptcy of FTX, Alameda Research and the occurrence of possible crises in other large groups active in this field have also condemned Bitcoin to failure.

According to the Stock Money Lizards team, the current market conditions are no different from previous liquidity crises in Bitcoin’s history.

This trading team said:

Recently we witnessed a true “black swan” event; FTX Bankruptcy. The history of Bitcoin is full of such events and the market will recover from it as before.

The chart below shows the location of crises similar to the current market situation on the price chart, and the first example dates back to the Mt. Gox hack in 2014.

Two other big examples include the hacking of the Bitfinex exchange in 2016 and the collapse caused by the worldwide coronavirus pandemic in 2020.

Zane Tackett, one of the former managers of the FTX exchange, recently suggested that this trading platform use the same model of liquidity recovery (token creation) of the Bitfinex exchange to get out of the current crisis. FTX instead filed for bankruptcy in the United States.

Filbfilb, co-founder of Decentrader, has predicted the formation of a multi-year recovery trend for Bitcoin. On the other hand, Binance CEO Changpeng Zhao, who at one point planned to buy FTX, said that the bankruptcy of this trading platform has set the digital currency industry back a few years.

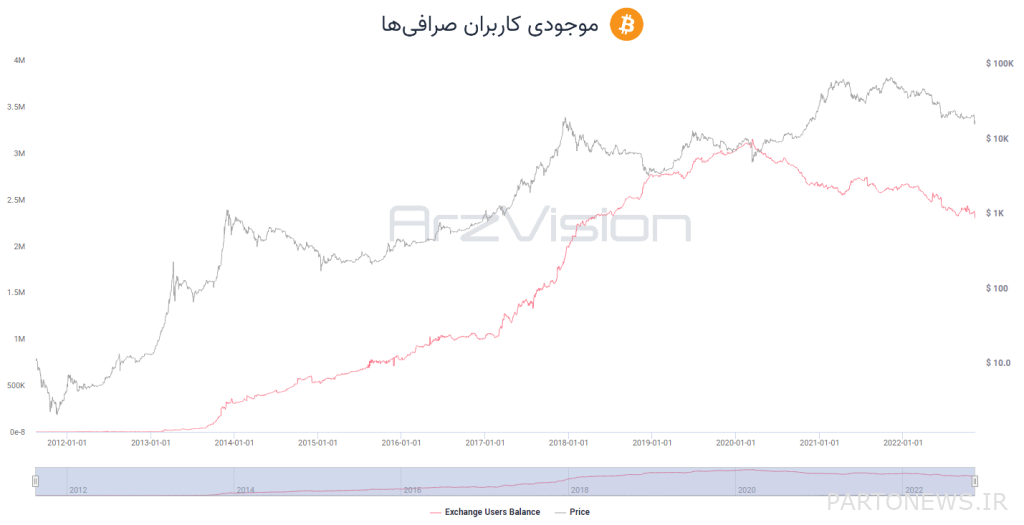

The decrease in the stock of Bitcoin exchanges to the lowest level in the last 5 years

The decrease in investors’ confidence in the market is clearly seen in the decrease in the stock of Bitcoin exchanges. According to the data IntrachainThe stock of Bitcoin exchanges is now at its lowest level since February 2018.

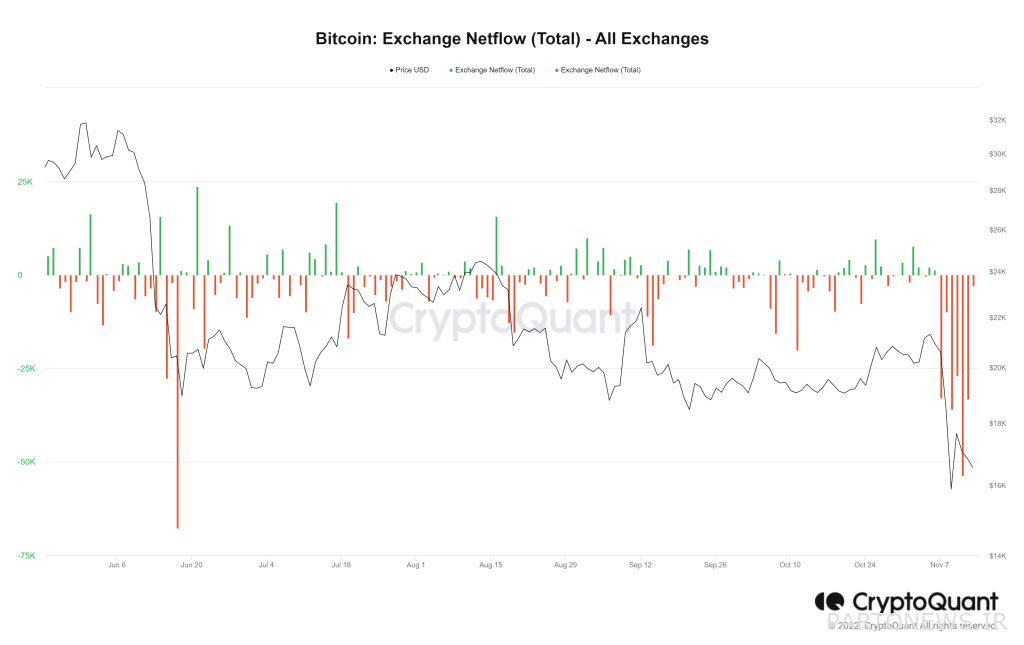

During November 9, 10, and 11 (November 18, 19, and 20), the inventory of exchanges monitored by the CryptoQuant analytical platform decreased by 35,000, 26,000, and 53,000 units, respectively. The amount of decrease in these three days is considered a record of several months in the changes in stock exchanges; But it is not more than the withdrawal of 67,700 units on June 17 (June 27) this year.

So far, various figures have asked users to transfer their funds from exchanges to personal (non-trust) wallets.

Seifuddin Amos, the author of the Bitcoin Standard book, also said:

Bitcoin exchanges are run by people who have learned fiat finance. Gambling with depositors’ money is considered normal and healthy for them; Because in a fiat system, with every mistake, the central bank devalues its currency to save deposits.