Bitcoin dominance rate re-emerges; The Altcoins are currently defeated

Available data show that Bitcoin is regaining its share of the digital currency market. In addition, the Atrium development team has not yet been able to achieve significant success in reducing the network’s fees.

To Report Coin Telegraph It seems that Bitcoin wants to get rid of the Coins and take back its share of the market. Last week, this digital currency was able to reach its dominance rate in November 2021 (November). Data for late January also show that Bitcoin accounts for more than 42% of the total digital currency market.

Bitcoin regains market share

Although the price of Bitcoin is now much lower than the historical peak of November, this digital currency with its latest moves was able to regain some of its lost share from the Altcoins.

Previously, tokens such as Atrium and Solana were able to take advantage of the weakness of the bitcoin market and attract the attention of most traders.

However, due to changes in the market, Bitcoin was able to regain its strength and maintain its dominance rate in the second half of January (40) in the range of 40%.

It is worth noting that the market value index can not be a complete measure of the strength of digital currencies; Because in this index, fixed tokens are placed next to tokens that have been launched for a short time. In addition, the value or effort behind a digital currency is not considered.

In the realized market value index, the unspent value of each transaction is valued based on the price of the digital currency in the last transaction. In fact, this index somehow shows how much it costs to buy each unit in circulation. Most analysts value this index more than its market value.

Messari’s in-chain data show that, unlike the market value index, the realized bitcoin market value index has not changed much since November last year, when the market was able to reach a new peak.

Atrium’s fees are much higher than Bitcoin

Atrium’s realized market value has fallen sharply since the fourth quarter of 2021. Given that the launch of Atrium 2.0 does not seem to solve the problem of rising network fees, many market participants still think that this digital currency can not compete with Bitcoin.

Dylan LeClair, an end-chain data analyst, said yesterday:

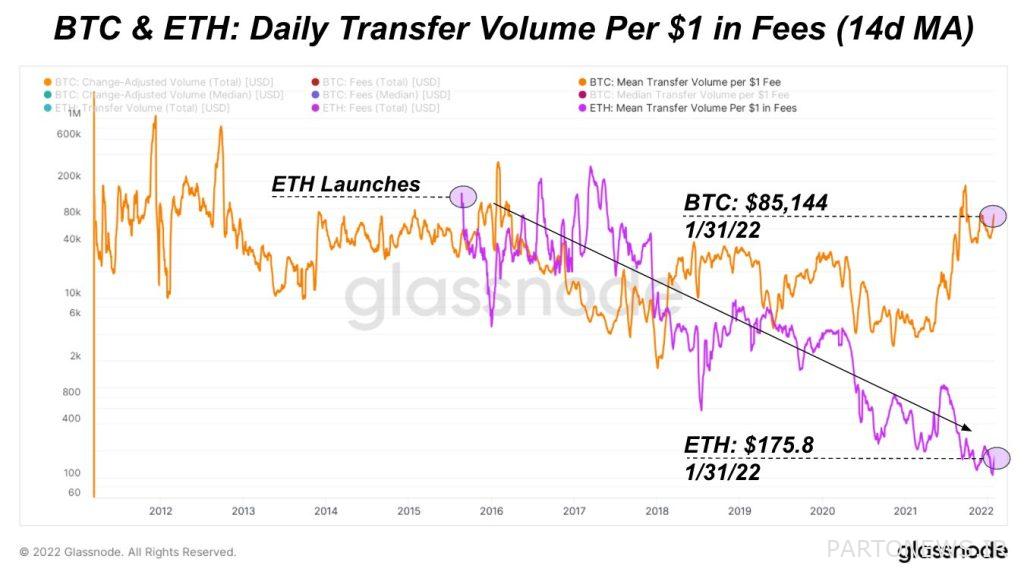

Unlike the Bitcoin network, Atrium is not built to store value or pay. As the price of Atrium native tokens has risen, its efficiency in payments has diminished since the project began.

The chart below shows the volume of digital currencies transferred per day for every $ 1 fee on the Bitcoin and Atrium networks. As you can see, the trend in this atrium network is declining; This means that Atrium’s fees have grown significantly compared to Bitcoin.

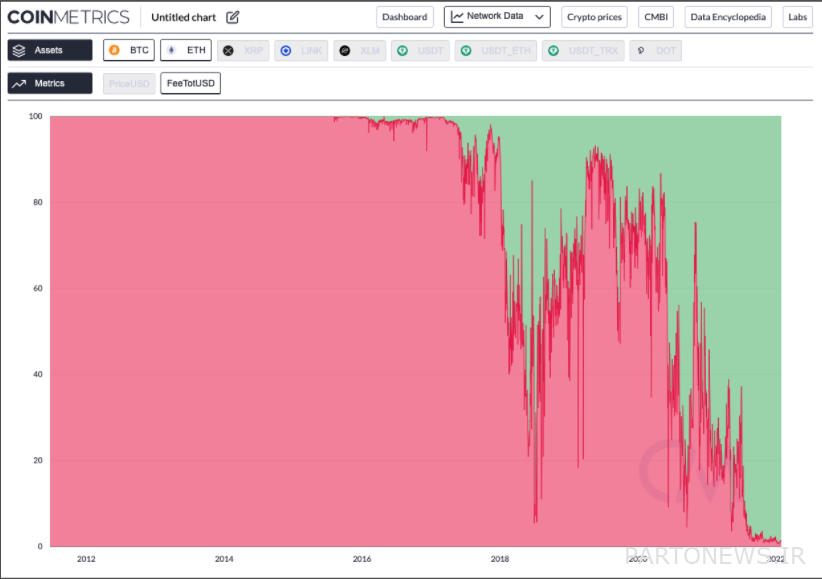

Available data show that Bitcoin network fees are currently only 1% of Atrium Network fees.

Chris Burniske, a current partner of Placeholder Police Investment Company, tweeted:

When I saw this data, it was almost impossible for me to believe it. Currently, the cost to traders on the Bitcoin network is only 1% of the Atrium network.