Can a 22% increase in the total value of stock exchanges / corporate assemblies cover the stock market?

According to the economic correspondent of Fars News Agency, the capital market started to decline in the second week of June and could not stabilize its 1.5 million units in the upper half of the channel.

The stock market faced a decline in small trades this week, and this could greatly challenge the upward trend of the stock market that had formed in recent weeks. The inflow of money into fixed income funds by small shareholders can be another negative point for the stock market.

Siamak Alavi, a capital market expert, in an interview with Fars News Agency economic reporter, about the stock market trend last week, said: “The capital market is involved in the technical resistance of the total index and the homogeneous total index, and this has reduced retail transactions.” Real shareholders will not be cautious until the market determines its orientation.

He continued: “If the trading process improves a little, parked capital will definitely enter the capital market, and this issue can be a factor in the growth of the stock market, along with the value of stocks and the relatively good reports of companies that have prepared for meetings.” Be in the coming weeks.

* Total index decline after weeks of growth

The overall stock index fell last week. This index decreased by 11 thousand and 86 units on Saturday, and decreased by 19 thousand and 344 units on Sunday. Of course, on Monday, the growth was 3,323 units and on Tuesday, it increased by 5,331 units. Finally, the total stock index ended the week with a drop of 731 units on Wednesday.

In the second week of June, the total stock index fell by a total of 22,507 units and reached the level of 1,541,980 units. The return of this negative index was 1.4%.

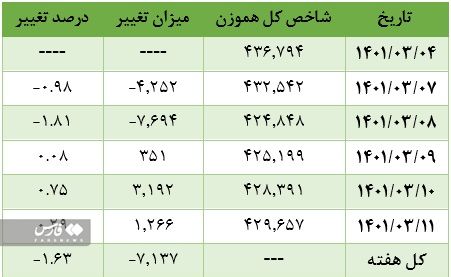

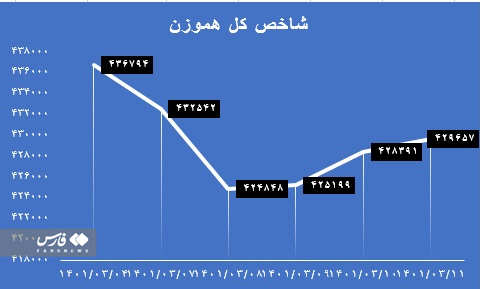

* Overtaking the total homogeneous index in negatives

The total homogeneous index had a downward trend last week like the total index. The index fell by 4,252 points and 7,694 points on Saturday and Sunday, respectively. The index grew by 351 units on Monday, increased by 3,192 units on Tuesday and climbed by 266 units on Wednesday.

The total homogeneous index finally returned to the level of 429,657 units in the second week of June with a drop of 7,137 units, so that it would have a negative return of 1.63 percent for shareholders.

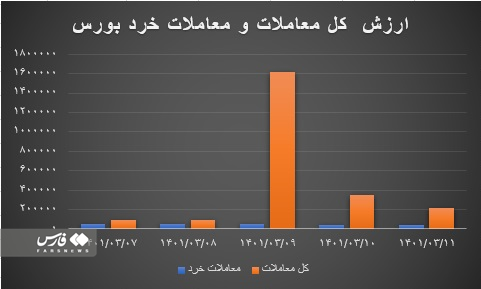

* Growth of the total value of capital market transactions

Last week, the average value of all stock transactions had an upward trend and grew by 22% compared to last week. Of course, this growth was due to the boom in bond trading in the secondary market. The average value of total stock exchange transactions this week has been 47 thousand and 618 billion tomans.

But the average value of retail transactions this week fell by 19% due to market uncertainties and the downward trend in market performance indicators. The average value of retail transactions in the second week of June was 4,643 billion tomans.

Capital market experts believe that if the law firms act to support the capital market and do not support only the index shares, we can hope for the growth of the stock market in the coming weeks. Of course, according to previous years, the total index can have an upward trend until the formation of stock exchange companies in the coming weeks, and this issue should change the trend of the capital market.

End of message /

You can edit this post

Suggest this for the front page