Housing construction is the best destination for targeted injection of liquidity

According to the economic correspondent of Fars news agency, the issue of the active approach of the government in liquidity management is a topic that Fars news agency has addressed in the form of various reports, for example, in the report entitled “The impact of the “liquidity improvement” policy on the Iranian economy/Maskan Mehr, how economic variables “Improved” this topic was discussed.

Based on the studies listed in economics sources, in the literature of this field, based on whether the growth of the monetary base is caused by the debt or asset side of the central bank’s balance sheet, two types of monetary base growth can be imagined.

* Does the growth of the monetary base happen in any area?

In this regard, the first axis is the growth of the monetary base caused by debt (Liability Driven), in this case, the growth of the monetary base is caused by the demand of banks; Banks need monetary base (reserves) to pay new facilities, deposit interest and interbank settlement. In this model, the bank usually pays the facility or deposit interest first, and then receives a monetary base from the central bank to provide the legal reserve rate or interbank settlement.

The second axis of the growth of monetary base is the growth of this index caused by assets (Asset Driven), in this case, the growth of monetary base is caused by expenses on the asset side of the Central Bank’s balance sheet. In other words, by spending the resources obtained from the sale of oil or borrowing from the central bank, the government increases the monetary base and injects reserves into the banks’ accounts with the central bank, and then the banks can use the provided reserves for other purposes, including paying bank interest. do

* The growth of the monetary base in 1401 was due to the overdraft of the banking system

The analysis of monetary developments in Iran in 1401 shows that the main growth of the monetary base in this year was caused by the debt side of the central bank’s balance sheet and due to overdrafts by banks.

In this regard, in an interview with Fars reporter, Ali Naderi Shahi, an economic expert, referring to the growth of monetary base, said in an interview with Fars reporter: Despite the control of liquidity growth, which was caused by the control of some balance sheet, the growth rate of monetary base has increased, in other words If the growth of the monetary base caused by the government’s borrowing from the central bank was actively increased, it should lead to a decrease in the interbank interest rate, we see that the interbank interest rate is also on an upward trend and has increased by more than 5% since the beginning of the government. .

Interbank interest rate details for the last 2 years

Naderi Shahi said: This shows that the source of monetary base growth was not from cheap resources borrowed by the government, but these banks were forced to borrow to provide reserves due to their contractionary policy and imbalances, and the monetary base grew from this source.

* The Minister of Economy emphasized on the proactive approach of the Central Bank

The issue of monetary base growth was mentioned by the Minister of Economy on the first day of the monetary and banking conference. Stating that the central bank should take an active policy regarding the supply of the monetary base in 1402, Khandozi said: In 1401, a large part of the growth of the monetary base was passive and from banks’ overdrafts.

According to the information of the central bank, the growth of the monetary base last year was more than 230 thousand billion tomans, which could be spent on construction projects if the central bank adopted an active policy. Based on this, it is estimated that the monetary base will grow by more than 250 thousand billion tomans this year, which must be spent on construction projects with proper planning and with the active intervention of the Central Bank. Otherwise, the monetary base will grow from banks’ overdrafts without any real return to the economy.

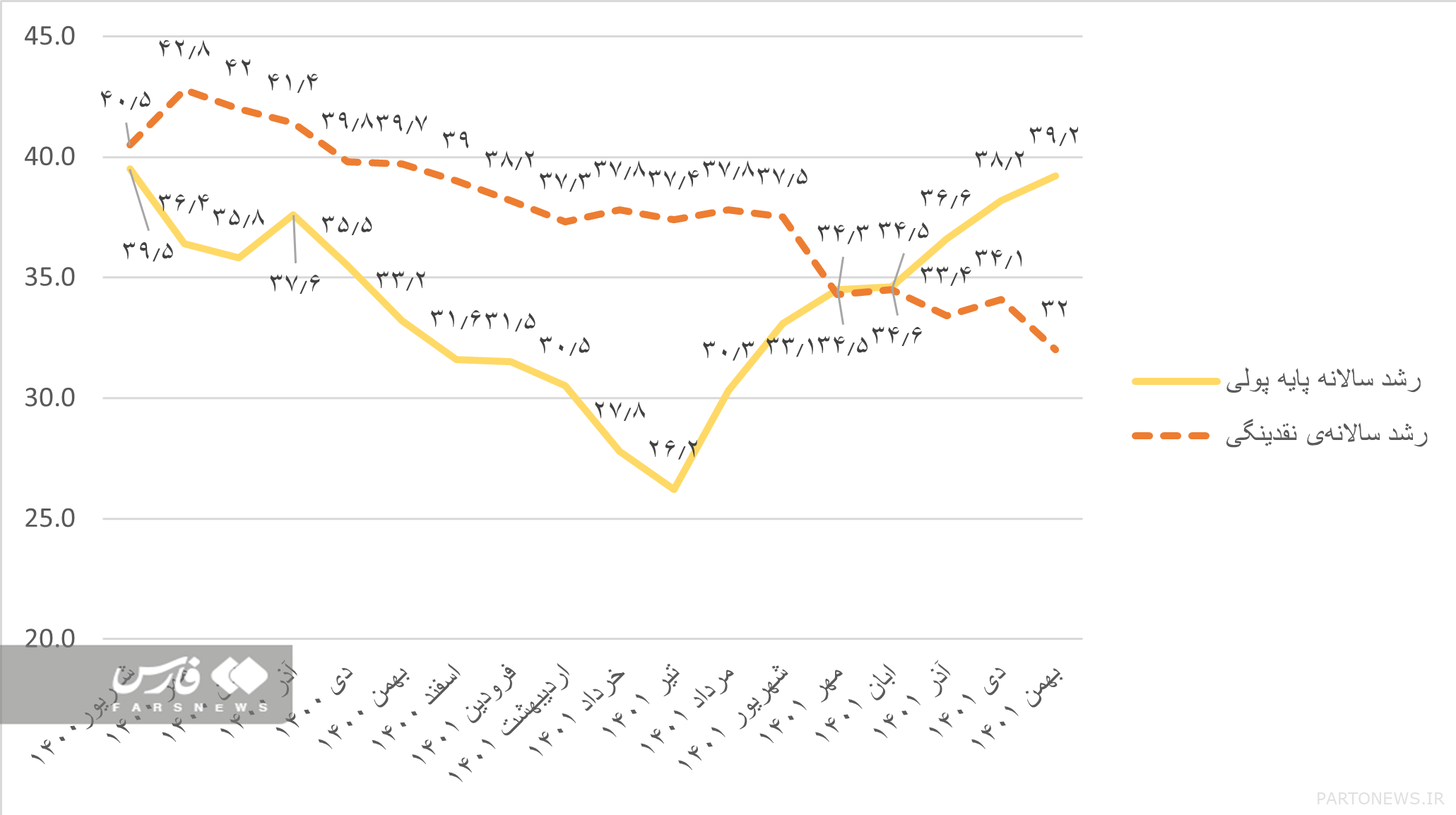

Annual growth of liquidity and monetary base in the last 2 years

* Directing the monetary base is possible after removing the overdraft

On the other hand Some economic experts also believe that directing liquidity and injecting the monetary base to construction projects should be done only in the condition that we see the complete removal of the overdraft of the banking system from the monetary base.

This group of experts Targeting for liquidity control is considered the most important program in order to curb inflation, and injecting the monetary base into the country’s production as well as preventing the overdraft of the banking system is considered in order to achieve the goal of liquidity control.

* Housing construction is the best destination for directing credit

In this regard, an economic expert tells Fars: According to the mentioned details, it seems that if the country’s monetary base is actively spent on construction projects, the ground for economic growth will be prepared. On this basis, purposes such as housing construction can be the best destination for directing credit.

According to Hasan Shivanjad, the most important construction promise of the president is to build one million residential units per year, providing housing as a basic need and a commodity that accounts for a high percentage of the family’s expenses will solve a large part of the family’s economic problems. For this reason, it is clear that the priority in allocating resources resulting from monetary policy change should be housing construction.

He added: Since the beginning of the government, the monetary base has increased by more than 300 thousand billion tomans. It meant solving the problem of more than one million of our compatriots.

This economic expert said: Providing banks’ reserves makes it possible for the banking system to be able to pay facilities as many times as the reserves (monetary base) created, which is the concept of the multiplier. Based on this, the government, centered on the Ministry of Roads and Urban Development, should enter into negotiations with banks that are willing to give several units of housing facilities for one unit of injected reserve. In this policy, the monetary base is provided only to banks that have better cooperation.

According to him, increasing the legal reserve rate, if it is accompanied by the current monetary policy, means increasing the role of the government in making credit allocation decisions. Considering that a large part of bank resources have been diverted from the productive sectors, the stronger presence of the government in allocating credits to public benefit and infrastructure projects will have better economic effects.

end of message/

You can edit this article

Suggest this article for the first page