How do digital currency activists react to Russian sanctions? Resistance or unconditional cooperation?

US and European governments have announced that companies and banks will no longer be allowed to trade or exchange money with Russian banks. Now some experts believe that Russia may be able to circumvent sanctions by using digital currency exchanges. But the question is, is there such a possibility, and if so, are exchanges and other businesses active in the field willing to enforce Western sanctions laws?

To Report With the escalation of Western and US economic sanctions against Russia, traders are worried about the impact of these sanctions on the digital currency market.

At present, Russia’s access to the international payment system SWIFT is largely blocked. In addition, American and Western businesses can not trade with or transact with Russian banks and the National Wealth Fund; But will businesses in the digital currency industry, like other Western institutions, cut ties with Russia altogether, or are they going to be treated differently?

CEO of Bainance: Exchanges, like banks, follow sanctions

Managers of digital currency exchanges have examined the economic sanctions against Russia and their possible effects with various arguments. Changpeng Zhao, CEO of Bainance Exchange, commented that most banks adhere to the sanctions, and that exchange offices such as Bainance follow the sanctions in nature.

He said:

Banks (hopefully most of them) follow sanctions. Digital currency exchanges (at least Bainance) will also operate under these sanctions. However, the media speaks as if digital currency exchanges do not sanction the ordinary people of Russia and do not adhere to the sanctions themselves. [ادعای رسانهها دروغ است].

Earlier, in an interview with Bloomberg, he said that it was “immoral” to impose sanctions on ordinary people in Russia.

Ripple CEO: Exchanges do not jeopardize their position to circumvent sanctions

Ripple CEO Brad Garlinghouse has criticized media outlets that say Russia is using digital currencies to circumvent economic sanctions. He spoke on Twitter about the process of creating digital currency exchanges and explained that trading platforms around the world work with different banks. As a result, if the sanctioned country or individual breaks all the rules and transacts on these platforms, the licenses of these exchanges will be jeopardized.

He said:

The RippleNet payment network, for example, has never worked with banks or sanctioned countries. [و از این به بعد هم کار نمیکند]. Ripple and its customers support and enforce the policies of the Office of Foreign Investment Control (OFAC) and its anti-money laundering and anti-money laundering laws.

Garlinghaus says digital currency exchanges use strict methods to prevent such adverse events from happening. These include strict enforcement of customer authentication and anti-money laundering regulations.

Chief Executive Officer: The liquidity in the digital currency market is not enough for Russia

Asheesh Birla, a senior executive at RippleNet, said that because digital currency transactions were largely traceable to governments and software, Russia could not use them to circumvent economic sanctions.

He wrote in a tweet on his page:

There has been talk in recent days that Russia could use digital currencies to circumvent Swift and impose sanctions. I reject these claims for the following reasons:

1. Software and governments can track digital currencies, and this is becoming increasingly easy for them.

۲. There is not enough liquidity in digital currency exchanges to meet Russia’s needs. It means the whole country of Russia needs foreign exchange reserves, not just the people present in this country.

3. Large financial institutions largely control the entry and exit portals of digital currencies, and as a result these portals (exchanges) are required to comply with the rules of the US Foreign Investment Control Organization.

Referring to the available data, Birla explained that the volume of Russian currency exchanges is about $ 50 billion a day. The total volume of bitcoin transactions per day is between $ 20 billion and $ 50 billion. As a result, this digital currency does not have the capacity to meet Russia’s needs.

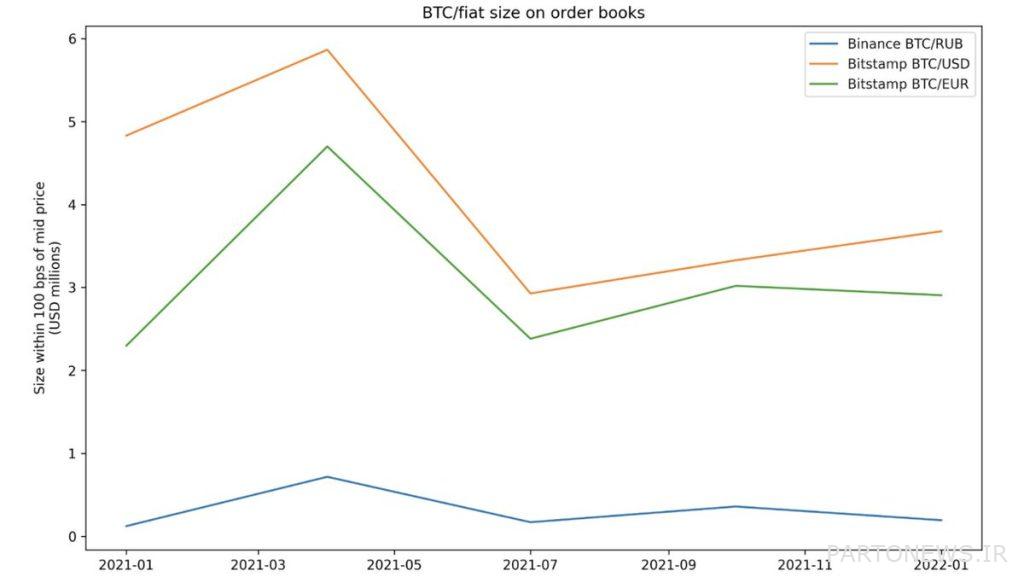

Explaining the chart below, he explains that from January 2022, only $ 200,000 can be placed in the Bitcoin / Ruble Bainance market each time. In addition, the Bitstamp exchange can place orders for $ 3.7 million in the Bitcoin / Dollar currency market and $ 2.9 million in the Bitcoin / Euro market. This means that the capacity of the order office of these exchanges will not be suitable for very large purchases in Russia.

As a result, if an order of $ 200,000 per minute is placed in the Bitcoin / Ruble Bainance market, and assuming that there is (and is not) the required supply and demand of transactions in this market, the total trading volume is still $ 50 billion. It does not happen during the day. It is worth noting that the average daily trading volume of the Bitcoin / Ruble Bainance pair last month was only $ 11 million.

CEO Kevin Bass: We will not boycott the Russians at this time

Brian Armstrong, CEO of Kevin Base Exchange, also expressed his views. He also believes that Russia can not circumvent sanctions by using digital currencies.

He said:

All American companies have to follow the laws of this country and it does not matter if these companies do their transactions with dollars, digital currency, real estate or any other non-financial assets. All companies and all individuals are required to follow these rules equally. We also do not think that the rich Russians can circumvent sanctions by using digital currencies. Digital currencies have an open general ledger. As a result, it will be easier to track large amounts of stolen money in the digital currency market than in the dollar, art, gold or other assets.

Armstrong has stressed that the exchange does not intend to take the lead in boycotting Russian users; Because he thinks that all ordinary people have the right to access basic financial services such as money changers. However, he explained that if the law forces them to boycott all active users in Russia, they will do so. It is worth noting that Russia is not currently on the list of supported areas of this exchange.

A representative of Queen Base recently announced that the company will comply with all sanctions imposed, including “blocking accounts and transactions that may be related to the sanctioned individuals or entities.”

The exchange has stressed that it will not enforce “informal rules” for non-sanctioned transactions and is trying to bring its activities into line with the sanctioned rules in various ways.