How to reduce the risk of your portfolio?

Life always has its ups and downs, and these fluctuations can destroy everything we make. Logic dictates that each person use a protective and caring approach in their life so that while facing possible dangers, they have the opportunity to take appropriate measures to reduce or compensate for the damage. Investment portfolio risk is one of the most important parameters for investors.

Markets such as digital currencies are no exception to this general rule. Just as you insure your home against various disasters, you need to take a similar approach to your other assets, such as digital currencies. If you neglect this, you will have to constantly wait for events to destroy everything you have built.

Hedging is different in each area; Therefore, in digital currencies, it has its own shape and appearance. Investors and traders in digital currencies can reduce the risks associated with investing in digital currencies by using profit-making methods, allocating capital to larger projects, and safely storing assets.

In general, risk hedging in transactions can be considered a risk management strategy that traders use to compensate for investment losses. Of course, in addition to the methods mentioned, experts have provided other ways to cover the risk.

Article The cryptocurrency website introduces us to some of these cover strategies and explains the importance and status of each. We invite you to continue reading this article with us.

It should be noted that this article was written at a time when various digital currencies have experienced very high growth, and it was written before the fall in prices in late November and early December 2021.

Familiarity with cover strategies in digital currencies

In the first place, it should be noted that digital currencies fluctuate and investing in them is not without risk. In recent weeks, many digital currencies have reached their all-time highs, and trading volume has increased this year. The digital currency market has experienced its highest market to date, while some believe the cycle could continue for several more months. However, the future movement of the market is unpredictable.

Read more: What is an All Time High and what does it matter?

When the market is bullish, too much optimism can overshadow traders’ rational decisions. Under these circumstances, as rates rise, investors are tempted to increase their trading leverage or ignore risk management strategies at this time; A kind of negligence that, when the market enters a downturn, can have surprising consequences.

The HODL mentality, or long-term retention of digital currencies and not selling, is not for everyone. For those who want to succeed in the world of digital currencies, there are several tried and tested ways to reduce your portfolio risk.

Average cost of dollars

Perhaps the simplest way to manage risk in a market is to simply turn an asset into money when prices rise. Of course, there are also risks involved in selling assets. Sometimes it is possible for a trader to leave the market early and prices will continue to rise, in which case they will lose more profit. This is where the popular DCA strategy comes into play.

Average means that instead of spending the entire capital on a purchase or a sale, we buy or sell gradually. DCA is well used in emerging markets such as digital currencies.

In this way, doubts about price movements can be managed. This method is also suitable for deciding when to sell. Instead of selling an asset in a bullish market, a trader can sell gradually as the market rises.

Many successful traders use this strategy in some way. Some people use DCA to buy digital currency gradually with a monthly salary and many others on a daily or weekly basis. Centralized exchanges such as CoinBase provide users with tools to automate the DCA strategy.

The history of digital currencies has shown that bearish or bearish periods in the market are the best times to accumulate and buy assets, and bullish or bullish markets are also the best time to sell. Therefore, to use DCA, you must act exactly when the market follows its normal nature and trend.

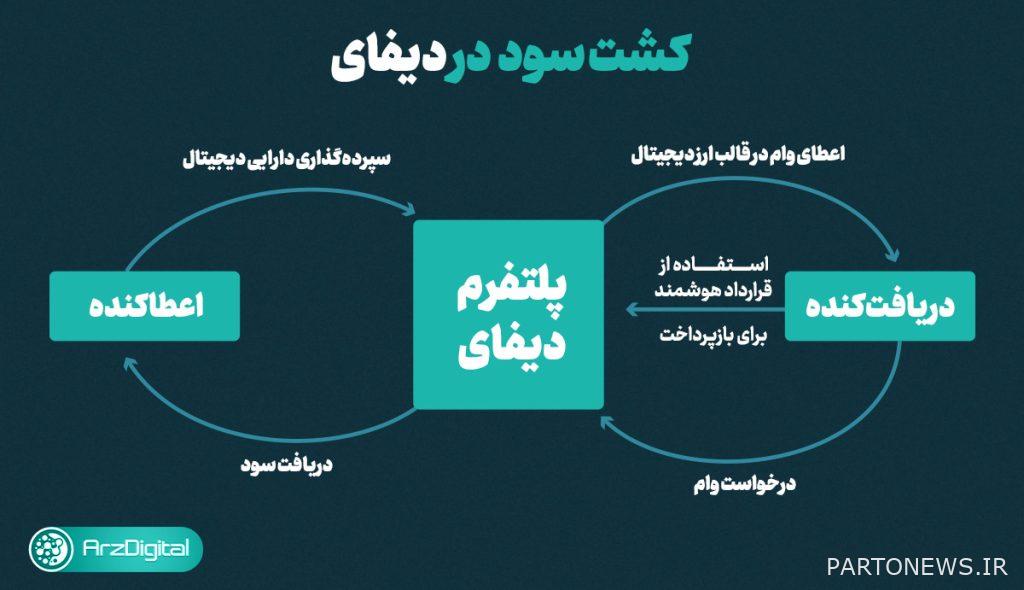

Profit cultivation and equity

The advent of decentralized finance or DeFi and stable coins has enabled investors to profit from their portfolio. Holding a portion of its assets in the form of stable coins presents investors with numerous and lucrative opportunities, including yield farming, as well as avoiding market fluctuations.

Defy protocols such as Anchor and Curve Finance offer double-digit profits, while newer liquidity pools offer much higher profits.

Note that new profit pools are also more risky.

Staking digital currency tokens is another effective way to earn passive income. The higher the price of the equity, the higher the return. Sharing tokens through various projects is a good way to make a profit. If the price of the asset falls, the investor will still benefit from the asset.

Intra-chain analysis and technical analysis

Trading and technical analysis require some level of knowledge and skill, but learning the basics is a good move for those looking to gain a foothold in the market. Learning does not mean buying expensive trading courses and technical analysis or spending time on short trades. However, knowing a few key indicators such as moving averages and… to make principled decisions when selling assets and making a profit is not a problem.

There are several tools for analyzing intra-chain activity; Like the Whale Parameter parameter or Funding Rate. Some other technical analysis is dedicated to finding the fair value of assets.

Analyzing the market overview from a macro perspective can also be useful; Because there are various factors that can affect the market. For example, before the Black Thursday event or the fall in the value of digital currencies, fears of the corona virus indicated that the market might be on the verge of massive sell-off by investors.

Storage of assets and security in Difai

One of the most important aspects of preserving digital currencies is the issue of storage. Using a proper wallet and keeping your passwords and keys private is really important. To store large amounts of digital currency, it is recommended to use cold wallets such as hardware wallets. It should be noted that hot wallets or software wallets are not a good security option for storing large volumes of digital currencies.

Although investors lock assets such as ETH in smart contracts to take advantage of defaults, there are other ways to protect assets against hacking and other risks. Projects like Nexus Mutual, which are similar to insurance service providers, protect investors’ assets against hacking of exchanges or bugs of smart contracts by selling risk coverage.

Build an investment portfolio

Building a portfolio is another important aspect of risk management. The choice of the asset to be purchased and its amount can have a significant impact on the overall risk of each individual portfolio. You should always consider the ratio between the amount invested in digital currencies to other assets and your savings accounts.

In addition, selecting the right digital currency projects for investment is an important part of risk management. Separating a portion of the investment portfolio specifically dedicated to trading from other segments plays an important role in risk management.

As a general rule, it is good to always consider the market value of each asset in your portfolio. Although large digital currencies such as Bitcoin and Atrium fluctuate, they are less risky and more liquid than projects with lower market value, while also taking advantage of the Lindy effect.

According to Lindy’s work, the longer a phenomenon (such as a technology) lasts, the more hope it has for survival. However, even low market value projects can have significant returns.

Building a portfolio ultimately depends on each individual’s risk-taking, financial goals, and investment schedules. Historical data show that investing in projects with larger market value can be profitable in the long run.

The investment portfolio can be assigned to different types of assets. The popularity and popularity of NFT tokens this year has made many collectors in the market making huge profits. Do not forget that this asset has less liquidity compared to digital currency tokens. Non-recurring tokens are non-exchangeable, while assets such as Bitcoin and Atrium can be traded at a certain price in any exchange.

Even when people’s interest in the market diminishes, it becomes very difficult to find a buyer at the right price, because unique tokens are an emerging technology in a fledgling space, so investing in them is still risky.

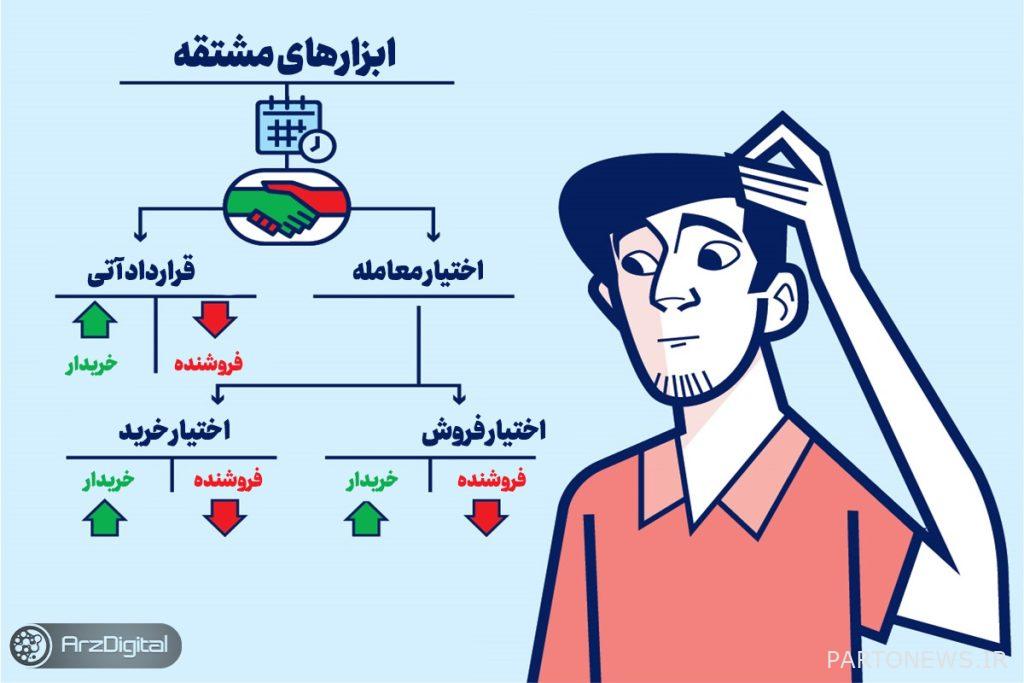

Option contracts

An option is a derivative contract that allows the buyer to buy or sell an asset at a certain price. For those with a digital currency portfolio, option trading is an effective way to reduce risk. Put Option provides the right to sell an asset at a specified price over a predetermined period of time. In this way, investors can sell and protect their investment portfolio if the market starts to decline.

In contrast, there is a call option, which provides an opportunity to buy an asset at a certain price in the future and is a kind of investment or somehow long-term bet. If the investor sells his asset at the beginning of the downtrend and later concludes that the market is bullish in the future, by holding the sell option contract, the investor will be able to repurchase the assets at a certain price. Options are complex products and are only recommended for investors and professional traders, yet they have very tempting returns for users.

Conclusion

In general, investing in digital currencies can be extremely profitable. Historically, digital currencies have shown a high capacity and potential that is not comparable to any other asset.

Although the field of digital assets is full of diverse opportunities and opportunities for investment and profit, the risk associated with this field should not be underestimated in any way. Investors in digital currencies should try to reduce their investment portfolio risk as much as possible by dividing their capital and allocating it to various topics such as defa, stock and… and taking advantage of parameters such as in-house analysis and dollar cost averaging.

In general, in any case, more profit is associated with high risk. Using risk hedging strategies can definitely lead to more risk adjustment and profitability.