Investing in NFTs; Do’s and Don’ts

2021 was the year of the flourishing of NFTs and strange events in this field. This year, NFTs became very popular and there was a huge frenzy to buy and sell all kinds of NFTs. For example, the CryptoPunks image collection, some of which sold for millions of dollars, and the “Everyday: The First 5,000 Days” painting by the famous digital artist Beeple, which sold another $ 69.3 million, set a record. “The Merge” was bought by an artist nicknamed “Pak” for $ 91.8 million.

Since the end of last year, with the decline of the digital currency market, the market for unique tokens has also declined and moved away from its original madness. Although the NFT market decline is as natural as any other market after a period of insanity, this has not dampened the interest in investing in unique tokens. Many experts still believe that the NFT sector will remain one of the investment trends in 2022.

In addition to lucrative opportunities, the market for unique tokens also carries great risks. Steven Finkelstein, data analyst, at an article Published on the Medium website, it provides some personal tips and advice on investing in NFTs. If you are planning to enter the market of unique tokens, we recommend that you stay with us until the end of this article to get acquainted with these points. You will read the rest of the article in the language of its author.

Practical tips for investing in NFTs

Over the past few years, I have immersed myself in the world of digital currencies and become quite addicted to it. I have just started researching NFT tokens and I have invested some money in this area; But only as a speculative investment.

Although I personally believe that 99% of the proverbial tokens will become completely worthless in the next year or two, it is tempting to think that I might be able to get one of those one percent; Just like when we buy a lottery ticket and think we are very likely to win.

The experience of investing in unique tokens over the past few months has taught me valuable lessons that I hope to share with you.

Unparalleled tokens are highly volatile

Investing in digital currencies and unparalleled tokens is not the job of daring people. If you can not afford 500% profit or loss overnight, stick to the same dull world of the stock market where 10% annual profit counts!

From my own experience, it has sometimes happened that I lost thousands of dollars overnight because of an NFT. There was a time when I made a profit of 1,000 percent in just a few weeks by investing in the Sandbox Transfer Digital Currency (SAND).

When you have invested in a speculative asset and that asset is falling to zero, you can easily sell it by instinct; But if the price of that asset is rising so fast, where do you want to know when to sell it?

In the world of NFTs, anything is possible

As you enter the space of inimitable tokens, you will soon become acquainted with the chaotic world of decentralized organizations (DAOs). Most decentralized organizations are run on the Discord social network.

In Discord, there are different communities that each have their own dozens of channels, software bots send automated messages, people advertise their digital currencies and unparalleled tokens, and in a nutshell, everything you can think of is available on this social network.

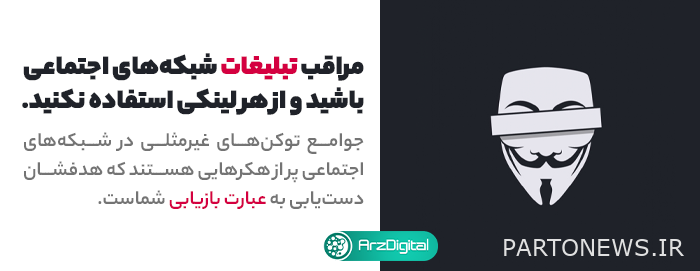

Although decentralized self-organizing organizations are fun and interesting, you have to be very careful if you want to register one of them in the community. Discord is full of hackers who send you malicious links or post them on channels, and their goal is to get the phrase “recover your wallet”.

There are many people who have been deceived by malicious links and given their recovery phrase to hackers. So make sure that you never enter your wallet recovery phrase after opening the link in Discord or any other social network.

Purchasing NFTs requires technical knowledge

In order to buy a unique token, you need to have some technical knowledge. Here are some things to look for when selecting yours:

- Register and create an account at one of the digital currency exchanges such as CoinBase, Gemina and FTX.

- Buy some Atrium (ETH) from that exchange.

- Create a digital currency wallet (like Metamsk).

- If you chose the Metamsk wallet, install the Google Chrome extension as well.

- Write down your Seed Phrase and Metamorphosis password somewhere off the Internet.

- Write down or copy the address of your Atrium wallet, which is a 64-character phrase.

- Your wallet to one of the NFT trading platforms like Open (OpenSea) Connect.

- Convert your Atrium currency from ETH to WETH.

- Buy the unique token you are looking for.

In general, buying proverbial tokens is a very complex process. In the meantime, there are some intermediary services that buy NFT on behalf of their customers; But these services are usually owned by celebrities and they also receive high fees.

A small percentage of people have the technical knowledge of the NFT purchase process. Even if you are one of the people who have the necessary knowledge and you do it personally, you may still have chosen the costly or insecure method.

Transaction fees are high in the NFT world

In the world of digital currencies, there are low-cost ways to trade with very little commission; But these methods have not yet entered the world of unparalleled tokens. Buying, selling, developing or transferring NFTs can have very high transaction costs. The cost of Atrium China blockchain transactions varies; But sometimes it can be as high as $ 100. Atrium’s fees vary based on supply and demand and China Blockchain design. If you are looking for lower wages, try one of the following:

- Perform transactions in Layer 2 protocols (such as Paligan)

- Digital currency exchange in decentralized exchanges (such as SushiSwap and UniSwap)

- Buying and selling unparalleled tokens in lower-paid blockchains (such as Solana)

- Doing transactions at times when demand is very low (such as holidays and special occasions such as Christmas).

You are solely responsible for the maintenance of purchased NFTs

Now suppose you watch a few videos on YouTube and TickTook and learn how to buy NFT. it is very good; But you should know that you have just passed the first problem and you have not yet come out of this difficult path.

Having a unique token or digital currency means that you are now a potential target for hackers. Assets in hot wallets (online types) are prone to being hacked by malicious actors.

Each time you need to enter the password or password for your Metamsk wallet, you must pause; Because you are linking your wallet to another online address. Every time you make this connection, you are at potential risk.

I suggest that you read thoroughly about security in this area before investing in digital currencies or counterfeit tokens. There are many articles and articles about NFT security that you can find and read by searching various websites. Also, do not forget that hardware wallets are much more secure than other types of wallets.

Your NFT may not be based on China Blockchain

Unparalleled tokens are made up of two parts: data and media (such as image and video). The data contains metadata that describes the non-allegorical token in question; Like the local address where the NFT media is stored. Some of this data is on the Chinese block; But the media is often outside the Chinese bloc.

Media is typically stored on IFPS, which is more secure than on individual servers or in the cloud; But it is not as secure as the Chinese block. The more information there is on the blockchain, the more secure your unique tokens will be. If the media is stored on a random server, the “mediator risk” increases, and it is very likely to be lost due to external factors.

The extent to which NFT is in-chain can be a good measure of pre-purchase evaluation. In other words, you can consider a spectrum with two poles: “fully in-chain” and “completely out-of-chain”, and before you buy NFT, check where this NFT is in this range. This requires a bit of technical knowledge; But it is necessary for NFT buyers.

It is difficult to find the right NFTs for your investment

If you, like me, believe that 99% of NFTs are worthless and worth zero in the future, then it will be difficult to find a worthwhile investment. I myself, after joining several decentralized organizations and constantly reading Twitter content about digital currencies and constantly following related podcasts, still have not found a good strategy for investing in unique tokens.

The field of non-parasitic tokens is still too new to provide a fundamental analysis or data-driven strategy. However, in the table below, I have included the research and recommendations I have encountered over the past month, along with my own answer:

Personally, I consider the two strategies of “investing in the works of favorite artists” and “investing in innovative concepts” to be the best strategy. In both methods, a set of unique tokens is purchased in its early days; That is, when the price is cheap. This reduces the probability of loss and increases the probability of profit, and makes it easier to diversify into investments.

Since the choice of NFT depends largely on luck, diversification is a necessity; But unfortunately this is neither easy nor cheap; Unless liquidity in this asset class increases and transaction fees fall sharply. Unless these two issues are resolved, proxy tokens will still be a very small percentage of my portfolio.

Conclusion

Non-recurring tokens are highly volatile assets that require you to incur large losses as much as you desire large profits to invest in them. Since the NFT field is an emerging market, many assets are just starting out. For this reason, you need to know when to sell your unique tokens to avoid the risk of a sudden fall.

Wherever there is a huge profit, it is undoubtedly a gathering place for fraudsters and hackers. So while you enjoy interacting and being present in communities of unparalleled tokens, watch out for scammers and malicious links. Never share your wallet recovery phrase with a person or site. Do enough research on how to keep your unique tokens safe. For example, having a hardware wallet is a good option for security.

Also, do not neglect transaction fees; Because the cost of transaction in the world of proverbial tokens is very high. Also consider the cost of commissions in your sales, or find ways to reduce those costs. Be aware that part of the NFTs (ie their media part) is stored somewhere other than the blockchain, which may not be as secure as the blockchain. Another point is to know how “in-chain” the token you are buying is.

In short, the field of non-parasitic tokens is still very young and there are no complete analytical methods to develop an appropriate investment strategy in this field; But studying the ideas and experiences of experienced investors can be a good start to enter this field.