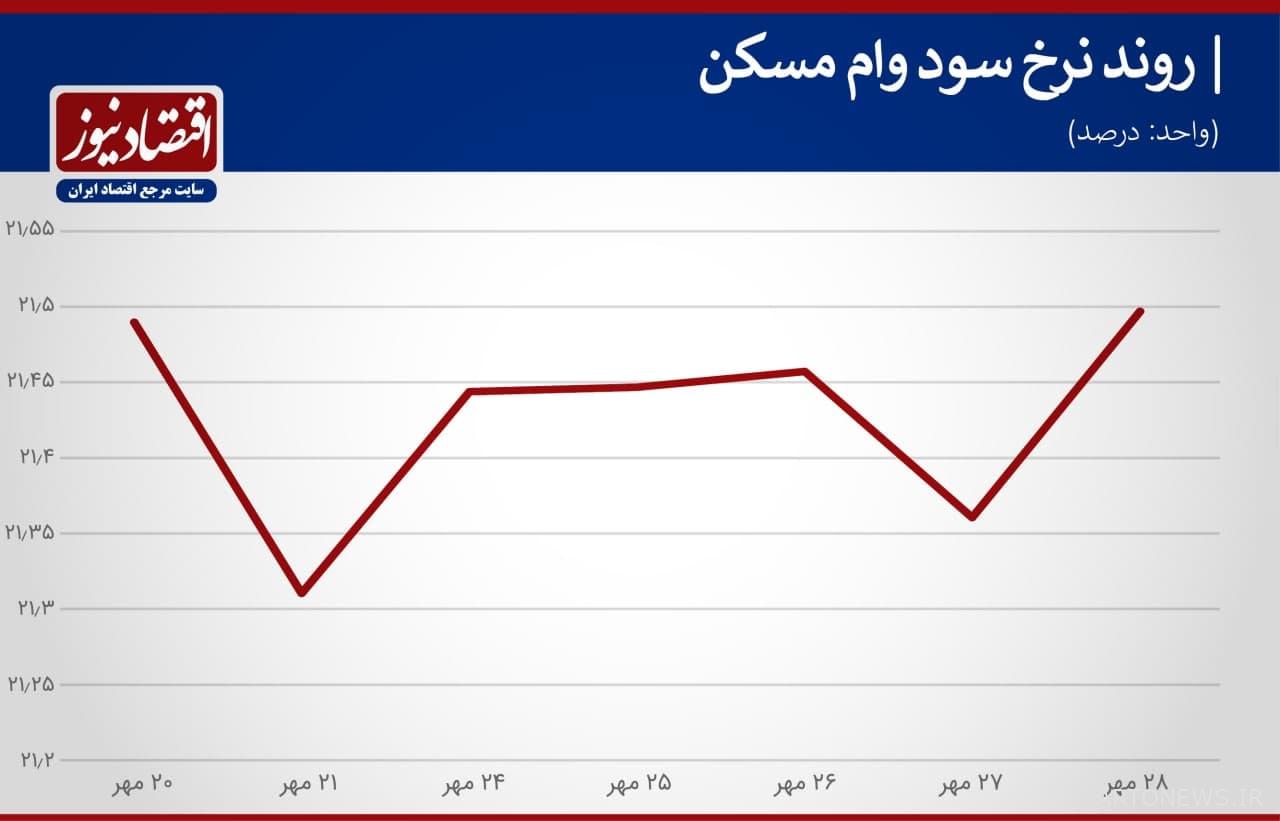

Mortgage interest rates reached 21.5 percent

According to Tejarat News, the cost of mortgages declined again at the beginning of the last week, but this path rose rapidly and finally recorded an increasing trend. In this regard, the mortgage interest rate increased to 21.5 percent on the last day of the last week of October.

The cost of buying housing bonds at the end of October

To receive a mortgage from this route, according to the rules of the Housing Bank, single people will need to buy 280 sheets and married people will need 480 sheets.

Accordingly, the total cost of purchasing TSE bonds in order to obtain a mortgage in the past week was calculated at 19 million and 500 thousand Tomans for singles on Saturday, October 15 and 19 million and 525 thousand Tomans on Wednesday, October 19.

A comparison between Wednesday, October 19, and Wednesday last week shows that the last week of October increased single mortgages by 3.9 percent.

At the beginning of the week, this figure was recorded at 33 million and 420 thousand Tomans for married people, which increased to 33 million and 470 thousand Tomans at the end, with an increase of nearly one million and 270 thousand Tomans compared to Wednesday of the previous week.

A review of the statistics of this variable last week has shown a fluctuating trend. According to the housing market data, two strokes have occurred in this process during this period. Since the 20th of October, when the trend of mortgage costs has dropped sharply in two days, this variable has suddenly increased and increased again.

For the first time, on October 12, the price of mortgages decreased by 3.6 percent, and on October 17, the second daily decline occurred, after which it found an upward path again. This decline on Tuesday this week is equal to It has been 1.9 percent.

But in general, it can be said that without considering the two price strokes in this market, the price of Tse bonds has been upward in these eight days.

Effective interest rate at the end of October

In this regard, the interest rate at the end of the third week of October for loan applicants was equal to 21.31 percent, in other words, 3.8 percentage points was still higher than the nominal amount.

This is while the figure has increased by 0.2 percentage points compared to what was recorded on Wednesday last week.

The rate is now at 21.5 percent, the highest in eight days.

The final cost of the mortgage at the end of October

An effective interest rate means that individuals must repay more than the loan they originally took out of the loan over the next 12 years. In this regard, the net net costs of single people who apply for a mortgage through the purchase of TSE bonds every day of the week and have to repay it to the bank within 12 years have fluctuated in parallel with the mortgage interest rate. Accordingly, the net payment cost of singles on Wednesday, October 19, was 179 million and 633 thousand tomans, and for married people it was 333 million and 395 thousand tomans.

Source: EconomyNews