Now is a good time to shop

Although Bitcoin has started the week with a downward trend and traders are not very optimistic about its growth in the short term, certain data show that current prices could be the starting point for long-term growth.

To Report On April 23, the Telegraph’s lower expectations of traders pushed the price of Bitcoin further and stabilized below the $ 40,000 range.

Traders were terrified as the Bitcoin price fell to $ 39,200

On Friday, Bitcoin, along with the global stock market, began a downward trend, falling to $ 39,200. Currently, the $ 40,000 range is the bitcoin resistance area, and traders in this digital currency have shown that they do not have much confidence in its return and growth in the short term.

Intra-chain data from the analytical website Coinglass shows that the situation of financing rates in derivatives markets has been completely negative until the beginning of this week. From this data, it can be concluded that most market participants had predicted a decrease in the price of Bitcoin and expected it to be more profitable to sell or enter short trading positions during this period.

The term capitalization in the futures market refers to the amount of commission that long-term holders (those who believe prices are rising) and short-term holders (those who believe prices are falling) must pay to keep the market in balance. .

Filbfilb, one of the founders of the Decentrader trading suite, has compared the ratio of long positions to bitcoin shorts and warned of their current state.

He wrote on Twitter:

When the price of Bitcoin was in the $ 47,000 range, the ratio of long positions to shorts was one to one. Now that the price is in the range of $ 39,500, this ratio has reached 3.5. This can be a concern.

Michaël van de Poppe, author of the Kevin Telegraph website, wrote on Twitter on Saturday:

Bitcoin is back in the $ 39,000 critical range. If it loses this range, its next target will be $ 36,000.

Bitcoin is in the $ 39,700 range at the time of this writing and has so far avoided entering the $ 38,000 area, which could be accompanied by the completion of a large portion of buy orders.

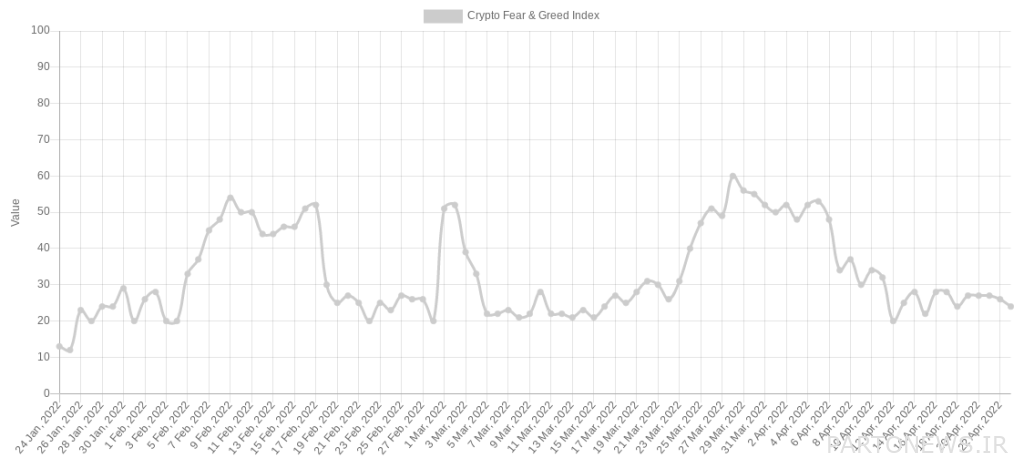

Meanwhile, the Fear and Greed Index returned to the “extreme fear” area on Saturday, showing that digital currency market traders are more hesitant than before.

An uptrend tied to the dollar market

Despite the distrust of some traders, it is not the case that all market participants have lost faith in the long-term and medium-term trends of bitcoin.

Crypto Rover, one of the most popular YouTubers in the digital currency market, has compared the performance of Bitcoin with the US Dollar Index (DXY) by publishing the chart below. This index compares the value of the US dollar with other major currencies in the world.

He said:

Prepare yourself for the next bitcoin uptrend. According to historical data, the current range is one of the best opportunities to buy bitcoin.

As you can see in the chart above, the US dollar index is currently almost at its two-year high. Given the inverse relationship between this index and the price trend of Bitcoin, it can be said that every time the US dollar index reaches its peak, Bitcoin finds the power to break its long-term downward trend.