Stop printing money without backing in the 13th government

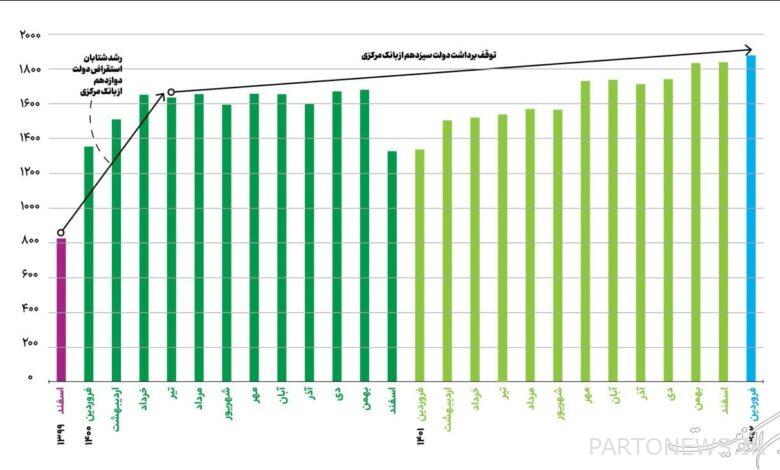

According to Iran EconomistIran Economic newspaper wrote: The latest report of the Central Bank of the country’s monetary indicators shows that government borrowing from the Central Bank, which was a common and deplorable practice during the eight-year period from 1392 to 1400 to solve the budget deficit, has been completely stopped.

The analysis of monetary statistics shows that the government’s debt to the Central Bank, as one of the main factors in the growth of the monetary base and liquidity, has been restrained in the 13th government, and its average monthly growth has decreased from 6% in the last year of Rouhani’s government to 0.9% in the President’s government. has been found

Based on this, the government’s debt to the central bank in the 13th government from August 1400 to the end of April 1402 has faced an average monthly growth of 0.9%.

At the end of July 1400, which is the last month of the previous government’s performance, the government’s debt to the central bank was 16,370 billion tomans. This figure has reached 187,790 billion tomans in April this year, which shows a monthly growth of 0.9%.

Meanwhile, in the last year of the last government, the government’s debt to the Central Bank faced an average monthly growth of 6% and an annual growth of 70%, which was mainly due to the government’s direct borrowing from the Central Bank to meet its current expenses, which increased The monetary base was also completed.

In the 4 years of the 12th government, the average monthly growth of the government’s debt to the central bank was 4.2 percent. In the total of 8 years of the 11th and 12th governments, the average monthly growth of the government’s debt to the Central Bank was 3.1%. In July 2013, the government’s debt to the central bank was only 18,900 billion tomans, which increased to 16,370 billion tomans in July 1400, which means that the government’s debt to the central bank increased 8.6 times during the Rouhani government.

But as mentioned, in the first 21 months of the 13th government’s performance, with the strict control that has been carried out, the government’s debt to the central bank has been severely curbed, so that its average monthly growth was only 0.9%, which means one-sixth of the growth of this index in a The last year of the previous government. The annual growth of the government’s debt to the central bank was 42% at the end of April this year, while it reached 70% at the end of Rouhani’s administration.

In the last year of Rouhani’s government, due to the extensive borrowing by the government from the Central Bank by printing excessive money, the government’s debt to the Central Bank grew by an average of 6% every month. But in the last two years, the 13th government has refused to receive any salary from the central bank at the beginning of the year, which has been customary in the last 40 years, in order to avoid affecting the growth of the monetary base and liquidity. In other words, by controlling its expenses and not borrowing from the central bank, the 13th government has severely restrained the government’s share of increasing the monetary base and liquidity.

Only in the last 4 months of the last government (ending July 1400), the government’s debt to the central bank increased by 81,000 billion tomans. This means that every month the government had withdrawn 20,000 billion tomans from the resources of the Central Bank.

Meanwhile, in the 21 months of the 13th government’s operation, the government’s debt to the central bank has only increased to 24 thousand billion tomans, which is equivalent to 1147 billion tomans per month.

The government’s net debt to the central bank decreased by 137 percent

Printing money without backing to cover the government’s budget deficit shows itself in the net increase of the government’s debt to the central bank;

• The net debt of the government (public sector) to the central bank in Shahrivar 1400 is equivalent to: 3.7 hemats

• The net debt of the government (public sector) to the central bank in April 1402 is equivalent to: minus 133.9 hemats

This means that the net debt of the government to the central bank has decreased by 137.6 hemats from September 1400 to April 1402.

However, the increase of 368.1 percent of the monetary base in the mentioned period is mainly due to two reasons;

A- The increase in the net foreign assets of the central bank by 157 hemats, of which more than 100 hemats of this increase was due to the difference between buying and selling currency at a preferential rate to supply the import of basic goods, which unfortunately changed from the previous government in 1400 to the 13th government. It had been inherited and with the implementation of the subsidy popularization plan in June 1401, the increase in the monetary base was neutralized.

b- The increase in the central bank’s demands from banks by 228 hemats, including for three reasons; 1- Implementation of regulatory policies of the central bank through increasing the total legal deposit and banks that exceed the monthly limit set for the growth of their balance sheets and subsequently increasing the demand of the central bank from banks that do not have sufficient surplus reserves. 2-Lack of liquidity in the banking network due to the implementation of the treasury unit account policy in the form of pooling the liquidity of the public sector with the Central Bank and 3- The lack of pumping high-powered money from the Central Bank to the banking network after the implementation of the subsidy popularization plan due to the difference in rates Buying and selling foreign exchange operations of the central bank to provide currency for basic goods