The Atrium market is not going to rise any time soon

A number of in-house indicators, as well as data on derivatives markets, indicate that Atrium prices are unlikely to reach above the $ 3,500 range any time soon. There is also always the risk of falling below $ 2,850.

To Report The Kevin Telegraph has seen a downward trend in the Atrium price chart, largely due to an 11 percent drop in the digital currency over the past month. However, other traditional financial assets have also undergone sharp revisions during this period. For example, during this period, the value of each share on the stock exchange traded fund (ETF) of Invesco China Technology, which consists of shares of companies operating on the Chinese stock exchange, fell by 31% and the Russell 2000 index (8). The percentage has decreased.

At present, analysts fear that the loss of support for the Atrium $ 2,850 downtrend channel could lead to a sharp drop in the price of this digital currency. However, the investigation of such an issue depends to a large extent on the transactions of derivatives market traders and in-chain data of the Atrium network.

The total value of locked capital (TVL) in the Atrium network has dropped to 27 million Atrium units in the last 30 days, according to Defi Llama. To measure the value of the total capital locked in Atrium, the number of tokens deposited in smart contracts, including Decentralized Finance (DeFi), Decentralized Token Markets (NFT), games and decentralized programs, is calculated.

The average Atrium network transaction fee rose to $ 13 after reaching $ 11.50 on April 20. However, traders need to consider whether this change reflects a reduction in the use of decentralized applications or merely an increase in the number of users using second-tier scalability solutions.

Atrium Premium Contracts contains bearish signs

Analysts use futures data to understand the orientation of professional traders. However, unlike perpetual futures trading, whales and maker traders prefer to use seasonal futures contracts; Because in this case, they can be protected from fluctuations in the rate of capital supply.

Capital ratios actually measure the difference between the price of long-term futures and the price in instant markets. In neutral markets, the annual premium (price difference) of Atrium futures contracts should be between 5 and 12 percent so that traders can lock their money until the contract expires.

Atrium 2% premium in recent days indicates a lack of demand for buying among leverage market traders. Although this value does not accurately indicate a reversal (negative premium) situation, traders usually consider it as a downtrend when the rate falls below 5%.

These data show that traders have had a neutral and downward outlook for Atrium over the past few months. However, in order to eliminate the external factors affecting the data related to derivative markets, we must also look at the internal data of the Atrium network. For example, examining network usage allows us to see if the actual volume of Atrium usage is to increase the price of this digital currency.

The data inside the chain does not matter

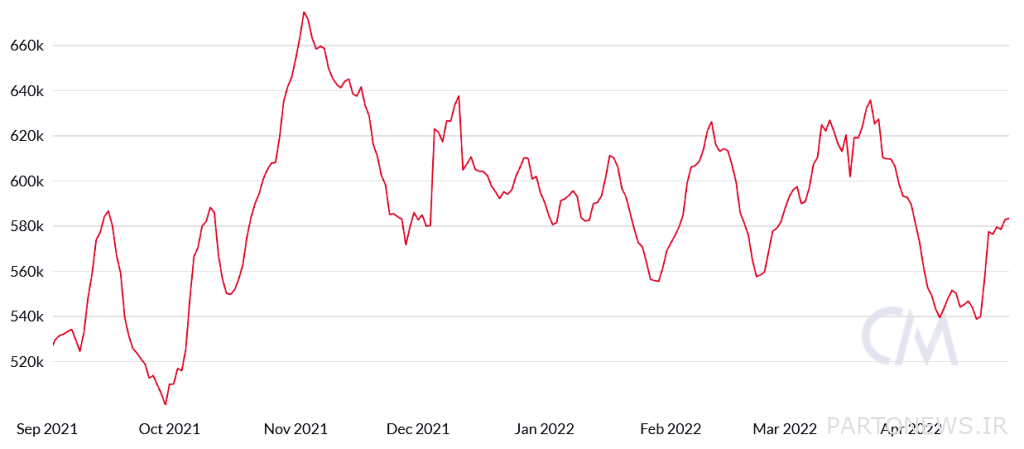

By measuring the number of active Atrium network wallets, a reliable and fast index can be obtained to measure the extent to which traders use this network. Although the growth of acceptance of second tier solutions may have diminished the credibility of this indicator, it can still be a good starting point.

The average number of 584,477 currently active daily addresses has decreased by 4% compared to the last 30 days and is by no means close to the average of 675,117 addresses in November 2021 (November 1400). As a result, based on these data, it can be said that Atrium network transactions, at least in the first layer, do not have any upward signs.

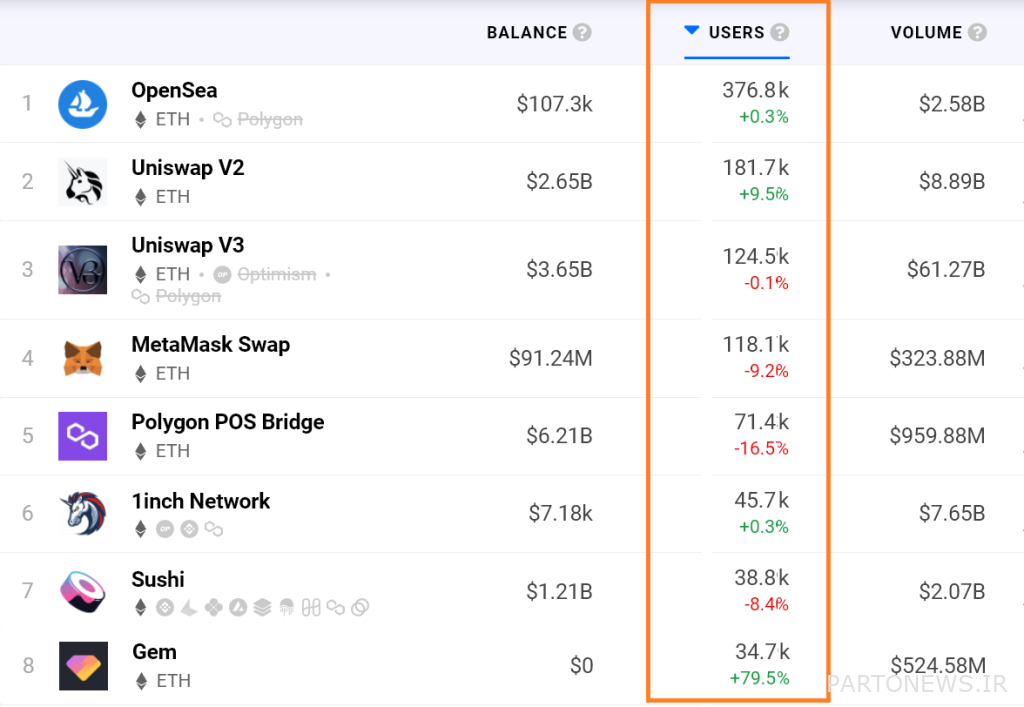

Traders must rely on indicators related to decentralized programs; But it should not be limited to examining the value of the total locked-in capital. This is because this rate is too focused on Diffy apps. By measuring the number of active URLs that show an increase or decrease in the number of users of these applications, a broader perspective of the digital currency market can be achieved.

The number of active addresses of Atrium Decentralized Network applications has decreased in the last 30 days. Given that the number of active addresses for decentralized network applications such as Solana has grown by 34%, Atrium Network data seems a bit disappointing.

Unless Atrium’s decentralized transactions and utilization rates grow well, the chart’s downtrend support at $ 2,850 is likely to break and fall deeper to lower levels.