The feeling of fumo among bitcoin investors has reached its highest level in the last 5 years; Ascending sign?

Inventory data from small bitcoin market investors show that these individuals are increasing their inventory at a remarkable rate. In the past, the increase in the stock of micro-investors has occurred mainly in periods when the price was close to its cross-sectional peaks; But is Bitcoin going to reach a new price peak this time around?

To Report Bitcoin Telegraph, the Bitcoin market is currently faced with the hasty purchase of small investors, but not everything may be as it seems. On April 4, William Clemente, a senior analyst at the Blockware Institute, tweeted about increasing the bitcoin holdings of small investors.

Institutions are usually considered as “micro-investors” and the dominant market flow, with a bitcoin balance of one or less, and are opposed to large corporate investors.

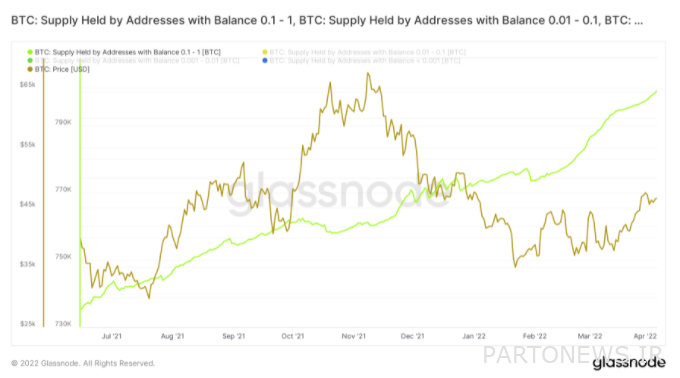

These small investors have dramatically increased their share of the total bitcoin supply in 2022, according to figures from Glassnode, an in-house analysis firm.

Clemente said such events have coincided in the past with sharp price increases; But given the recent behavior of bitcoin prices, the situation seems to be different this time around.

He said:

This chart is really interesting. Micro-investors (addresses with holdings between 0 and 1 bitcoin) are trading in a situation where their holdings have reached their second all-time high. By looking at the inventory chart of these addresses, it can be seen that there is a jump in this chart [معمولاً] Has coincided with a sharp rise in prices; But in many cases, they have bought strategically [و درگیر احساس فومو نشده بودند]. This is why the recent increase seems unusual.

According to Golsnood, each group of micro-investors, which is categorized on the basis of inventory from 1 bitcoin to 0.001 bitcoin, has increased its market share over time; But since mid-February (late February), there has been a dramatic increase. Currently, addresses with holdings between 0.1 and 1 hold a total of about 800,500 bitcoins.

Clemente added:

Either we are doomed or small investors have chosen to use bitcoin as a savings account and a way to opt out of the Fiat system. My optimism gives me more hope for the second option.

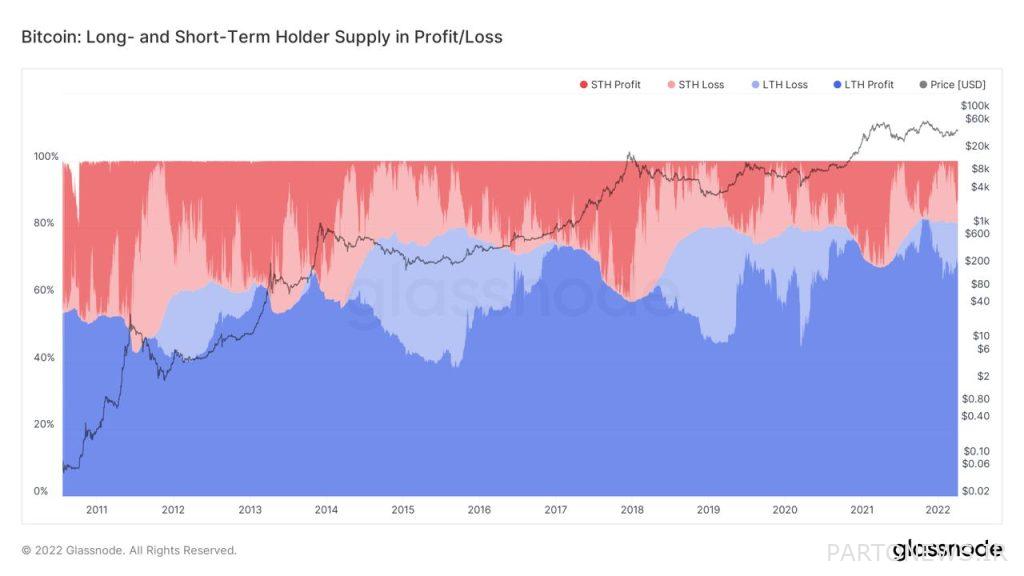

As bitcoin approaches $ 50,000 and is out of trading by 2022, the share of short-term holders’ “profitable supply” (those who have been in the market for 155 days or less) has also increased; This means that more units are now available to these people, which have been purchased at a lower price than the current prices.

Golsnood data show that the change in the stock status of short-term bitcoin holders from loss to profitability has also been accompanied by price increases in recent years.

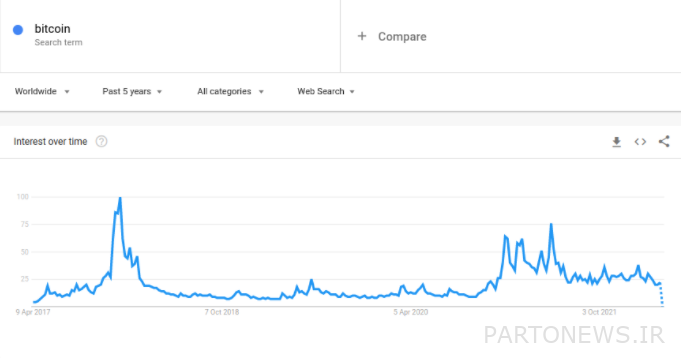

What does Google Data say?

At the moment, with the price of Bitcoin approaching $ 50,000, investor activity and intra-network trading volume are under very close scrutiny; But public attention to bitcoin is still clearly low.

Google Trends data on the worldwide search for the keyword “Bitcoin” shows the lowest interest in searching for Bitcoin before the price break in November 2021.

As Google data shows, this trend is still declining, and if the downward trend continues, Bitcoin will be among the lowest relative search volume in recent years.

Also read: Can Bitcoin price be predicted by checking Google searches?