Concerns of an Iranian insurer

According to the monetary financial news – in the midst of holding the National Insurance Day, we asked Ali Salahinejad, one of the experts and senior managers of the Iranian insurance industry, to tell us about the current situation of the Iranian insurance industry, the existing problems and solutions. Despite their busy schedule, they agreed and sent the text to the magazine along with an audio file. The following text is the result of aggregation and summary of these two files.

The insurance industry is not much considered by economic activists these days, but why?

During the rapid outbreak of coronary heart disease, the insurance industry faced two conflicting events. The positive part of the event was that, unlike many other industries affected by the epidemic, the insurance industry did not suffer significant damage and, in some cases, even recorded good growth rates; For example, in the third party insurance sector, on the one hand, the premium rate increased by 37%, and on the other hand, with the restrictions that were created to prevent the spread of the corona for people to travel, the reduction in damages was very significant in the third sector. There is also significant growth in health insurance because people, aware of the transmission power of the corona virus in different varieties, did not go to hospitals much to use their insurance policies to treat non-emergency cases. But the negative event is related to the economic situation of the country. Despite the sanctions, the recession finally spread in the country and people’s incomes decreased, and therefore part of the insurance products were almost removed from the household basket.

Another influential issue on the insurance industry was the withdrawal of the United States from Borjam, which affected foreign insurance relations with Iran, especially in the reliance sector, and forced foreign companies to make a trade-off with Iran or American-European companies. To choose.

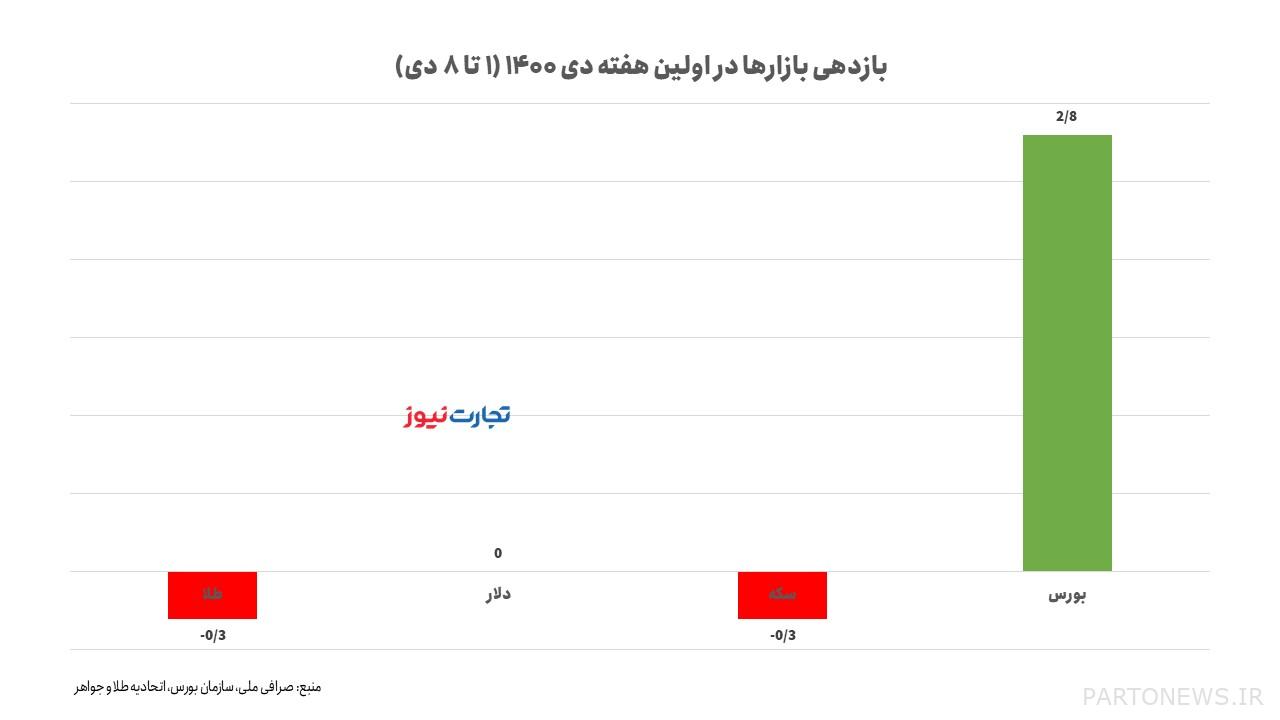

Another issue is the decline in the stock market index in the last year, which has a significant impact on the investment portfolio of insurance companies, and from this perspective, we should expect a reasonable return on their investment.

Of course, despite the problems in the last year, insurance companies have done a good job, which means that they have taken the opportunity and changed it by changing the portfolio. However, some problems still exist and have created obstacles to the growth and excellence of the country’s insurance companies.

- Problems of the insurance industry today

First, there is the traditional and inappropriate structure that unfortunately exists in companies. This structure prevents the necessary changes and increases the speed of activity in the industry.

Second is the lack of attention needed to develop life insurance. This type of insurance is considered a very important factor for the development of the industry.

Third is the lack of attention to the training of experts in the risk management sector. In this regard, the industry is facing a shortage of specialized personnel.

Fourth, I think the rules and regulations that exist in insurance activities.

Fifth, the continued existence of tariff systems in the insurance industry has created problems. For example, 30 to 40% of the insurance industry portfolio is now in the possession of a third party, and the calculation of insurance premiums is based on tariffs.

Sixth, there is a lack of cooperation between the insurance industry and universities, which in my opinion does not exist and we have not been able to succeed in this area.

Seventh, there are problems and ambiguities that exist in some regulations of regulatory bodies, including central insurance, for example, the ambiguities of Regulation 97 (related to investment) and Regulation 69 (related to financial wealth of insurance companies) have not been resolved yet. .

Eighth, interest rate changes in life insurance have created confusion among buyers of this important insurance product compared to other financial market products, including banks and stock exchanges.

- What is the solution to reduce the problems?

To solve the problems, the government must first decide not to enter into the enterprise debate anymore, especially in the insurance industry, which is a young and dynamic industry and many private companies have entered it. Because usually the activities that the government enters as a holding company, due to the lack of competition, that activity can not play its role in the market properly. Of course, the government can play an effective role in the development of the insurance industry, as it has played a leading role in the past, and now it can strengthen its control, oversight and support role by reducing it. We know that the insurance industry is an important management tool and is effective in controlling social pressure and can also play a vital role in a resilient economy; Therefore, it seems that government support in creating a culture and creating a healthy competitive environment for the insurance industry and encouraging the private and public sector to use insurance as a support factor in the investment sector in the country and this is a high cultural activity. Is the term.

– 10 suggestions to strengthen the insurance industry

1- Strategic information technology planning in the insurance industry

2- Modifying the structure of central insurance information technology

3- Development of e-government

4- Strengthening electronic supervision in the insurance industry

5- Standardization

6- Development of electronic insurance

7- Strengthen risk management

8- Improving the human resource management of the insurance industry

9- Improving information security management and passive defense

10. The speed of balanced development of the insurance industry through data analysis technology

Source – Financial News Magazine